Question: Round to nearest dollar please. D Question 28 3 pts All Coal Mines Ltd. (ACM) a mining company is evaluating a new plant for a

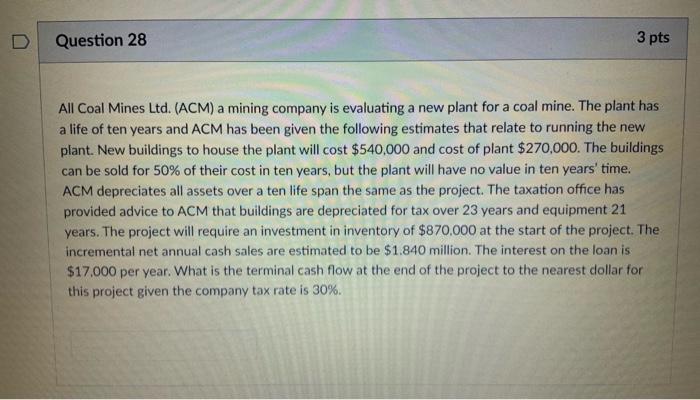

D Question 28 3 pts All Coal Mines Ltd. (ACM) a mining company is evaluating a new plant for a coal mine. The plant has a life of ten years and ACM has been given the following estimates that relate to running the new plant. New buildings to house the plant will cost $540,000 and cost of plant $270,000. The buildings can be sold for 50% of their cost in ten years, but the plant will have no value in ten years' time. ACM depreciates all assets over a ten life span the same as the project. The taxation office has provided advice to ACM that buildings are depreciated for tax over 23 years and equipment 21 years. The project will require an investment in inventory of $870.000 at the start of the project. The incremental net annual cash sales are estimated to be $1.840 million. The interest on the loan is $17.000 per year. What is the terminal cash flow at the end of the project to the nearest dollar for this project given the company tax rate is 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts