Question: Round to two or three decimal places the answer if possible :) Nikken Microsystems (B). Assume Nikken Microsystems has sold internet servers to Telecom Espaa

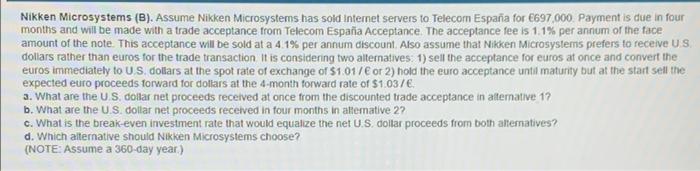

Nikken Microsystems (B). Assume Nikken Microsystems has sold internet servers to Telecom Espaa for 697 000. Payment is due in four months and will be made with a trade acceptance from Telecom Espaa Acceptance. The acceptance fee is 1.1% per annum of the face amount of the note. This acceptance will be sold at a 4.1% per annum discount. Also assume that Nikken Microsystems prefers to receive U.S. dollars rather than euros for the trade transaction it is considering two alternatives: 1) sell the acceptance for euros at once and convert the euros immediately to US dollars at the spot rate of exchange of $1.01/ or 2) hold the euro acceptance until maturity but at the start sell the expected euro proceeds forward for dollars at the 4-month forward rate of $1.037 a. What are the US dollar net proceeds received at once from the discounted trade acceptance in alternative 19 b. What are the US dollar net proceeds received in four months in alterative 2? C. What is the break-even investment rate that would equalize the net U.S. dollar proceeds from both alternatives? d. Which alternative should Nikken Microsystems choose? (NOTE: Assume a 360-day year)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts