Question: Round your answers to three (3) decimal points. Given the following balance sheet and income statement on a company, use the DuPont identity to calculate

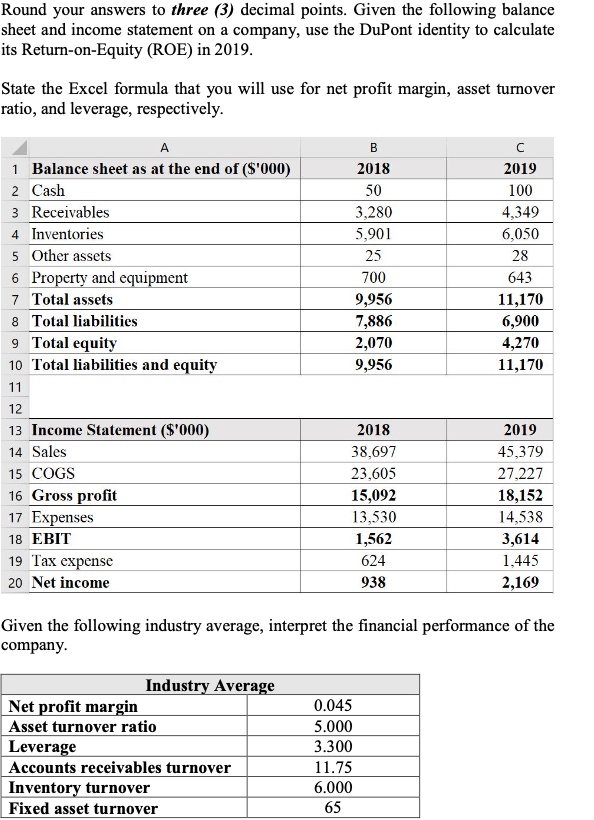

Round your answers to three (3) decimal points. Given the following balance sheet and income statement on a company, use the DuPont identity to calculate its Return-on-Equity (ROE) in 2019. State the Excel formula that you will use for net profit margin, asset turnover ratio, and leverage, respectively. 1 Balance sheet as at the end of ($'000) 2 Cash 3 Receivables 4 Inventories 5 Other assets 6 Property and equipment 7 Total assets 8 Total liabilities 9 Total equity 10 Total liabilities and equity 11 12 13 Income Statement ($'000) 14 Sales 15 COGS 16 Gross profit 17 Expenses 18 EBIT 19 Tax expense 20 Net income B 2018 50 3,280 5,901 25 700 9,956 7,886 2,070 9,956 2019 100 4,349 6,050 28 643 11,170 6,900 4,270 11,170 2018 38,697 23,605 15,092 13,530 1,562 624 938 2019 45,379 27.227 18,152 14,538 3,614 1,445 2,169 Given the following industry average, interpret the financial performance of the company Industry Average Net profit margin Asset turnover ratio Leverage Accounts receivables turnover Inventory turnover Fixed asset turnover 0.045 5.000 3.300 11.75 6.000 65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts