Question: Rounding: 2 DECIMALS!! Liabilities: Journal Entries Notes/Accounts Payable & Interest Egnab Inc. had the following transactions during the current fiscal year ending December 31st. Aug.

Rounding: 2 DECIMALS!!

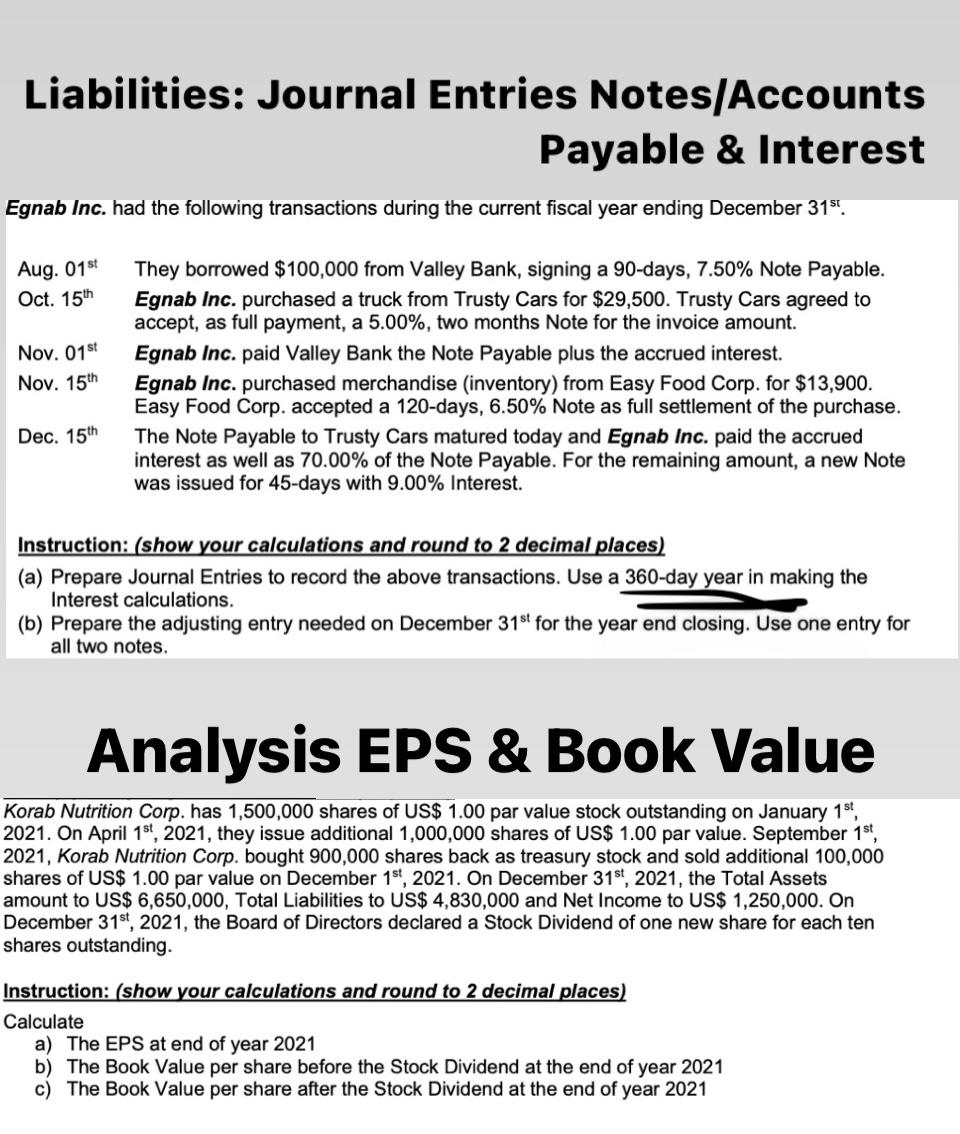

Liabilities: Journal Entries Notes/Accounts Payable \& Interest Egnab Inc. had the following transactions during the current fiscal year ending December 31st. Aug. 01 1st They borrowed $100,000 from Valley Bank, signing a 90-days, 7.50% Note Payable. Oct. 15 Egnab Inc. purchased a truck from Trusty Cars for $29,500. Trusty Cars agreed to accept, as full payment, a 5.00%, two months Note for the invoice amount. Nov. 01 Egnab Inc. paid Valley Bank the Note Payable plus the accrued interest. Nov.15Dec.15thEgnabInc.purchasedmerchandise(inventory)fromEasyFoodCorp.for$13,900.TheNotePayabletoTrustyCarsmaturedtodayandEgnabInc.paidtheaccruedinterestaswellas70.00%oftheNotePayable.Fortheremainingamount,anewNote was issued for 45 -days with 9.00% Interest. Instruction: (show your calculations and round to 2 decimal places) (a) Prepare Journal Entries to record the above transactions. Use a 360-day year in making the Interest calculations. (b) Prepare the adjusting entry needed on December 31st for the year end closing. Use one entry for all two notes. Analvsis EpS \& BOK Value Korab Nutrition Corp. has 1,500,000 shares of US\$1.00 par value stock outstanding on January 1st, 2021. On April 1st,2021, they issue additional 1,000,000 shares of US\$ 1.00 par value. September 1st, 2021 , Korab Nutrition Corp. bought 900,000 shares back as treasury stock and sold additional 100,000 shares of US\$ 1.00 par value on December 1st,2021. On December 31st,2021, the Total Assets amount to US\$6,650,000, Total Liabilities to US\$4,830,000 and Net Income to US $1,250,000. On December 31st,2021, the Board of Directors declared a Stock Dividend of one new share for each ten shares outstanding. Instruction: (show your calculations and round to 2 decimal places) Calculate a) The EPS at end of year 2021 b) The Book Value per share before the Stock Dividend at the end of year 2021 c) The Book Value per share after the Stock Dividend at the end of year 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts