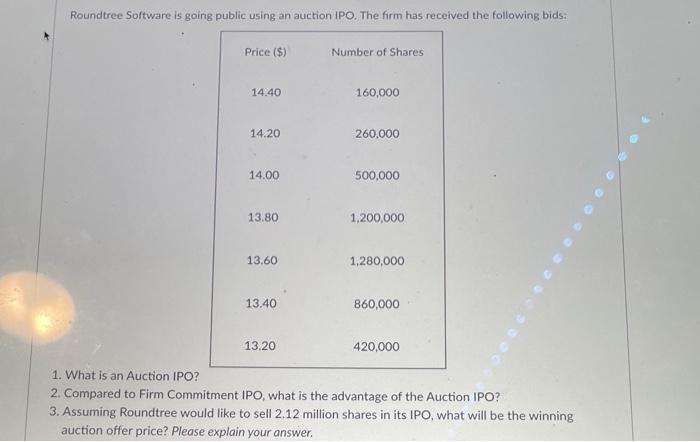

Question: Roundtree Software is going public using an auction IPO. The firm has received the following bids: Price ($) Number of Shares 14.40 160,000 14.20 260.000

Roundtree Software is going public using an auction IPO. The firm has received the following bids: Price ($) Number of Shares 14.40 160,000 14.20 260.000 14.00 500,000 13.80 1,200,000 13.60 1,280,000 13.40 860,000 13.20 420,000 1. What is an Auction IPO? 2. Compared to Firm Commitment IPO, what is the advantage of the Auction IPO? 3. Assuming Roundtree would like to sell 2.12 million shares in its IPO, what will be the winning auction offer price? Please explain your answer. 1. What is the indirect cost of financial distress? 2. Firms have (higher/lower) leverage ratio when the indirect cost of financial distress is large. Please explain your answer. 3. Below are four types of indirect costs of financial distress. Choose any two of them and explain how these factors impact firm's capital structure choices. Loss of Customers Loss of Suppliers Cost to Employees Fire Sales of Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts