Question: Rowan Housing Front Dask Banking Streaming Chase Calleg - Chase.com M lectures.mhhe.com/connect/0077511204/guided_examples/Chapter X2012/12-15.mp4 HW #11 Chapter 12 Problems HW #11 Chapter 12 Problems i Saved

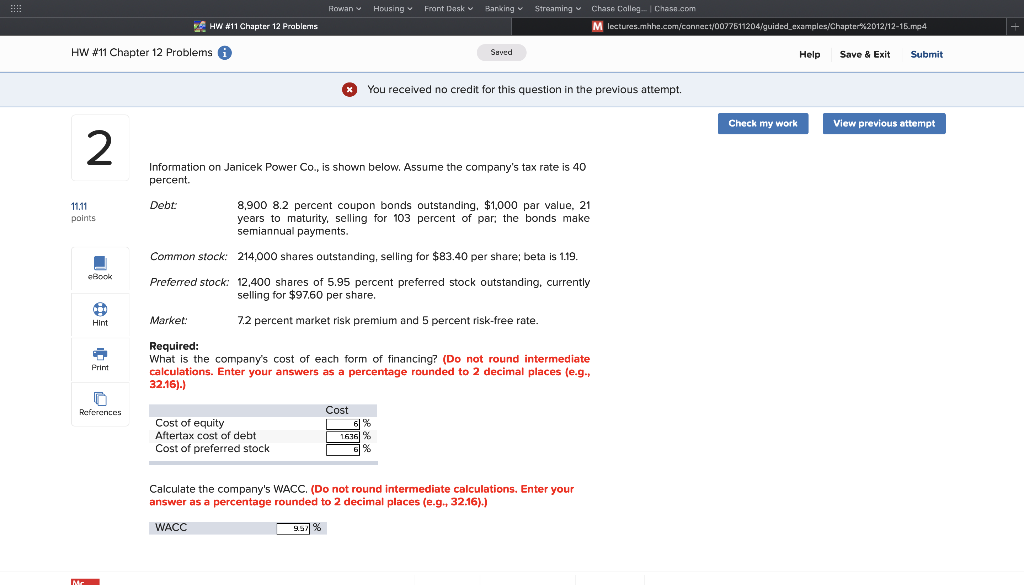

Rowan Housing Front Dask Banking Streaming Chase Calleg - Chase.com M lectures.mhhe.com/connect/0077511204/guided_examples/Chapter X2012/12-15.mp4 HW #11 Chapter 12 Problems HW #11 Chapter 12 Problems i Saved Help Save & Exit Submit x You received no credit for this question in the previous attempt. Check my work View previous attempt Information on Janicek Power Co., is shown below. Assume the company's tax rate is 40 percent. Debt: 11.11 points 8.900 8.2 percent coupon bonds outstanding. $1,000 par value, 21 years to maturity, selling for 103 percent of par; the bonds make semiannual payments. Common stock: 214,000 shares outstanding, selling for $83.40 per share; beta is 1.19. eBook Preferred stock: 12,400 shares of 5.95 percent preferred stock outstanding, currently selling for $97.60 per share. Hint Market: 7.2 percent market risk premium and 5 percent risk-free rate. Print Required: What is the company's cost of each form of financing? (Do not round intermediate calculations. Enter your answers as a percentage rounded to 2 decimal places (e.g., 32.16).) References Cost Cost of equity Aftertax cost of debt Cost of preferred stock Calculate the company's WACC. (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places (e.g 32.16).) WACC 9.97%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts