Question: RSM332 Spread Payoff ST X Xta X + 2a X +3a 4. A RSM332 spread is a combination of option positions that involves four strike

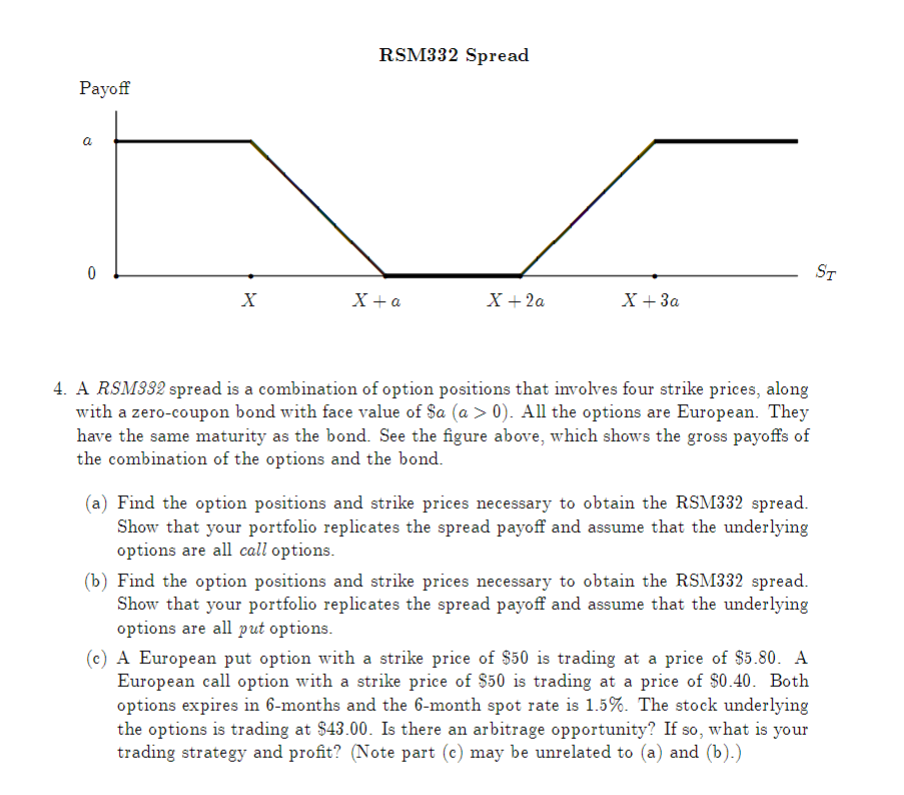

RSM332 Spread Payoff ST X Xta X + 2a X +3a 4. A RSM332 spread is a combination of option positions that involves four strike prices, along with a zero-coupon bond with face value of $a (a >0). All the options are European. They have the same maturity as the bond. See the figure above, which shows the gross payoffs of the combination of the options and the bond. (a) Find the option positions and strike prices necessary to obtain the RSM332 spread. Show that your portfolio replicates the spread payoff and assume that the underlying options are all call options. (b) Find the option positions and strike prices necessary to obtain the RSM332 spread. Show that your portfolio replicates the spread payoff and assume that the underlying options are all put options. (C) A European put option with a strike price of $50 is trading at a price of $5.80. A European call option with a strike price of $50 is trading at a price of $0.40. Both options expires in 6-months and the 6-month spot rate is 1.5%. The stock underlying the options is trading at $43.00. Is there an arbitrage opportunity? If so, what is your trading strategy and profit? (Note part (c) may be unrelated to (a) and (b).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts