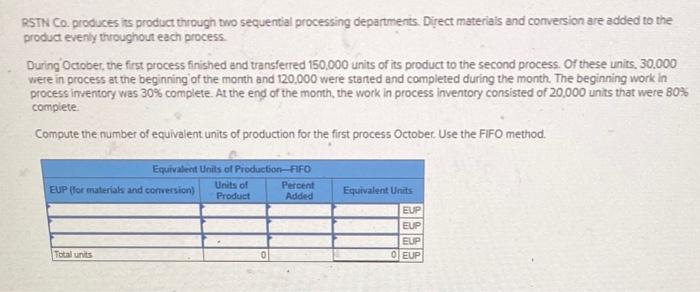

Question: RSTN Co. produces its product through two sequential processing departments Direct materials and conversion are added to the product evenly throughout each process. During October,

RSTN Co. produces its product through two sequential processing departments Direct materials and conversion are added to the product evenly throughout each process. During October, the first process finished and transferred 150,000 units of its product to the second process. Of these units. 30.000 were in process at the beginning of the month and 120.000 were started and completed during the month. The beginning work in process inventory was 30% complete. At the end of the month, the work in process inventory consisted of 20,000 units that were 80% complete Compute the number of equivalent units of production for the first process October. Use the FIFO method Equivalent Units of Production-AIFO Units of Percent EUP for materials and conversion) Product Added Equivalent Units EUP EUP EUP O EUP Total units In a process costing system, the entry to record cost of materials assigned to a production de potement requires a debit to the Work In Process Inventory account for that department and a credit to the Raw Materials Inventory account True or False True False if the Indirect labor cost in August for clerical and maintenance that help production in all departments was $123,000, the following Journal entry would be recorded in a process costing system: 123,000 Factory Overhead Factory Wages Payable 123,000 True or False True False If the predetermined overhead allocation rate is 75% of direct labor cost, and the Assembly Department's direct labor cost for the reporting period is $20,000, the following entry would be made to record the allocation of overhead to the products processed In this department: Factory Overhead Work in Process Inventory, Assembly Dept. 15,000 15,000 True or False True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts