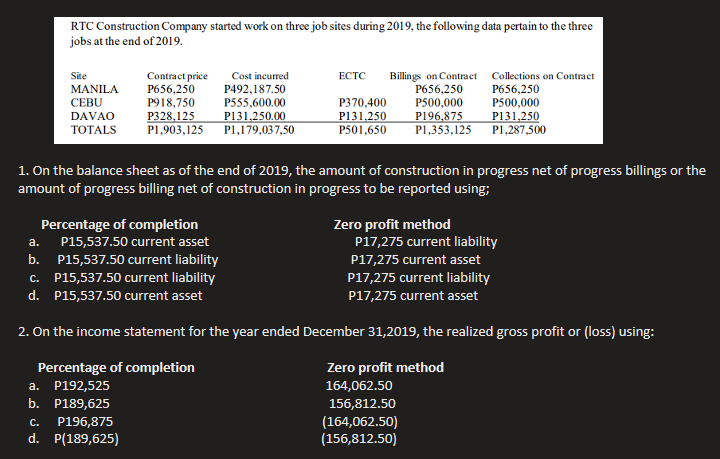

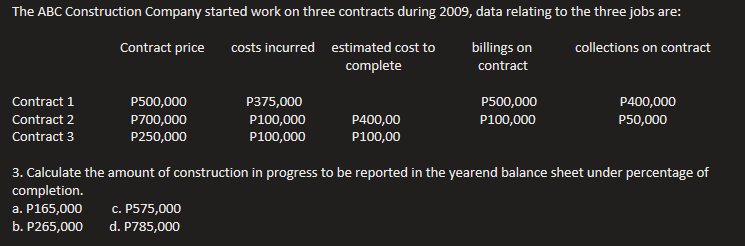

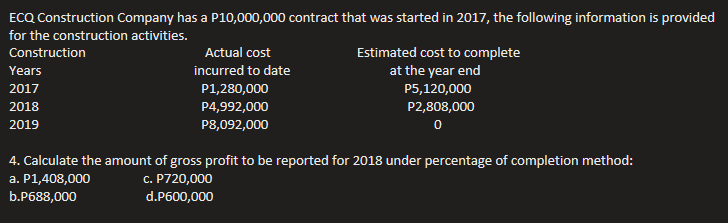

RTC Construction Company started work on three job sites during 2019, the following data pertain to the three jobs at the end of 2019. Site Contract price Cost incurred ECTC Billings on Contract Collections on Contract MANILA P656,250 P492,187.50 P656,250 P656,250 CEBU P918,750 P555,600.00 P370.400 P500,000 P500,000 DAVAO P328,125 P131,250.00 P131.250 P196.875 P131,250 TOTALS P1.903,125 P1,179,037,50 P501.650 P1,353,125 P1,287,500 1. On the balance sheet as of the end of 2019, the amount of construction in progress net of progress billings or the amount of progress billing net of construction in progress to be reported using; Percentage of completion Zero profit method a. P15,537.50 current asset P17,275 current liability b. P15,537.50 current liability P17,275 current asset C. P15,537.50 current liability P17,275 current liability d. P15,537.50 current asset P17,275 current asset 2. On the income statement for the year ended December 31,2019, the realized gross profit or (loss) using: Percentage of completion Zero profit method a. P192,525 164,062.50 b. P189,625 156,812.50 C. P196,875 (164,062.50) d. P(189,625) (156,812.50)The ABC Construction Company started work on three contracts during 2009, data relating to the three jobs are: Contract price costs incurred estimated cost to billings on collections on contract complete contract Contract 1 P500,000 P375,000 P500,000 P400,000 Contract 2 P700,000 P100,000 P400,00 P100,000 P50,000 Contract 3 P250,000 P100,000 P100,00 3. Calculate the amount of construction in progress to be reported in the yearend balance sheet under percentage of completion. a. P165,000 C. P575,000 b. P265,000 d. P785,000ECQ. Construction Company has a P10,000,000 contract that was started in 2017, the following information is provided for the construction activities. Construction Actual cost Estimated cost to complete Years incurred to date at the year end 2017 P1, 280,000 P5,120,000 2018 P4,992,000 P2,808,000 2019 P8,092,000 4. Calculate the amount of gross profit to be reported for 2018 under percentage of completion method: a. P1,408,000 C. P720,000 b.P688,000 d.P600,000