Question: RTDA: Data Exercise 5 Real-Time Data Analysis Exercise Real-time data provided by Federal Reserve Economic Data (FRED), Federal Reserve Bank of Saint Louis Using data

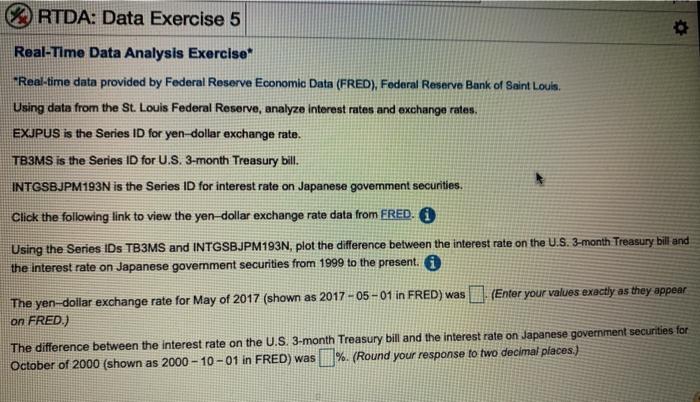

RTDA: Data Exercise 5 Real-Time Data Analysis Exercise "Real-time data provided by Federal Reserve Economic Data (FRED), Federal Reserve Bank of Saint Louis Using data from the St. Louis Federal Reserve, analyze interest rates and exchange rates, EXJPUS is the Series ID for yen-dollar exchange rate. TB3MS is the Series ID for U.S. 3-month Treasury bill. INTGSBJPM193N is the Series ID for interest rate on Japanese government securities. Click the following link to view the yen-dollar exchange rate data from FRED. Using the Series IDs TB3MS and INTGSBJPM193N, plot the difference between the interest rate on the U.S. 3-month Treasury bill and the interest rate on Japanese govemment securities from 1999 to the present. The yen-dollar exchange rate for May of 2017 (shown as 2017 05 01 in FRED) was (Enter your values exactly as they appear on FRED.) The difference between the interest rate on the U.S. 3-month Treasury bill and the interest rate on Japanese government securities for October of 2000 (shown as 2000 - 10-01 in FRED) was %. (Round your response to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts