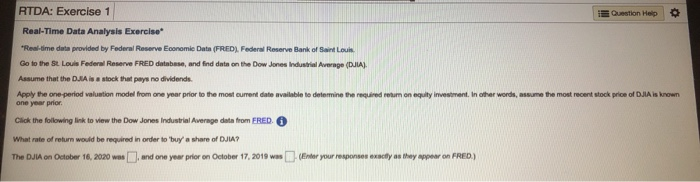

Question: RTDA: Exercise 1 Question Help Real-Time Data Analysis Exercise Real-time data provided by Federal Reserve Economic Data (FRED). Federal Reserve Bank of Saint Louis Go

RTDA: Exercise 1 Question Help Real-Time Data Analysis Exercise "Real-time data provided by Federal Reserve Economic Data (FRED). Federal Reserve Bank of Saint Louis Go to the St. Louis Federal Reserve FRED database, and find data on the Dow Jones Industrial Average (DA) Assume that the DA is a stock that pays no dividends. Apply the one period valuation model from one year prior to the most current date available to determine the required retum on equity investment. In other words, assume the most recent stock price of DJIA is known one year prior Click the following link to view the Dow Jones Industrial Average data from FRED What rate of return would be required in order to buy'a share of DJIA? The DJIA on October 16, 2020 was, and one year prior on October 17, 2019 was (Enter your responses exactly as they appear on FRED) RTDA: Exercise 1 Question Help Real-Time Data Analysis Exercise "Real-time data provided by Federal Reserve Economic Data (FRED). Federal Reserve Bank of Saint Louis Go to the St. Louis Federal Reserve FRED database, and find data on the Dow Jones Industrial Average (DA) Assume that the DA is a stock that pays no dividends. Apply the one period valuation model from one year prior to the most current date available to determine the required retum on equity investment. In other words, assume the most recent stock price of DJIA is known one year prior Click the following link to view the Dow Jones Industrial Average data from FRED What rate of return would be required in order to buy'a share of DJIA? The DJIA on October 16, 2020 was, and one year prior on October 17, 2019 was (Enter your responses exactly as they appear on FRED)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts