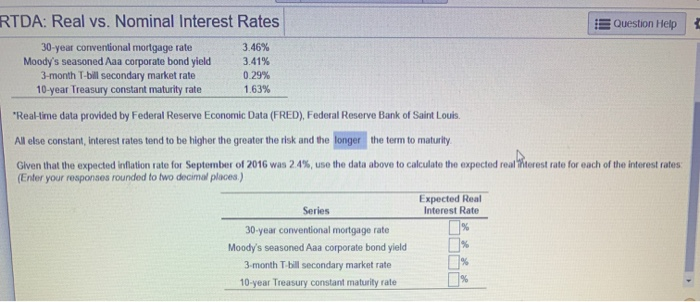

Question: RTDA: Real vs. Nominal Interest Rates Question Help 30-year conventional mortgage rate 3.46% Moody's seasoned Aaa corporate bond yield 3.41% 3-month T-bil secondary market rate

RTDA: Real vs. Nominal Interest Rates Question Help 30-year conventional mortgage rate 3.46% Moody's seasoned Aaa corporate bond yield 3.41% 3-month T-bil secondary market rate 0.29% 10-year Treasury constant maturity rate 1.63% "Real-time data provided by Federal Reserve Economic Data (FRED), Federal Reserve Bank of Saint Louis. All else constant, interest rates tend to be higher the greater the risk and the longer the term to maturity Given that the expected indiation rate for Septomber of 2016 wan 2,4%, use the data above to calculate the expected roat Worest rate for each of the interest rates: (Enter your responses rounded to two decimal places) Expected Real Series Interest Rate 30-year conventional mortgage rate Moody's seasoned Aaa corporate bond yield 3-month T-bill secondary market rate 10-year Treasury constant maturity rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts