Question: Ruby is 25 and has a good job at a biotechnology company. She currently has $12,400 in an IRA, an important part of her retirement

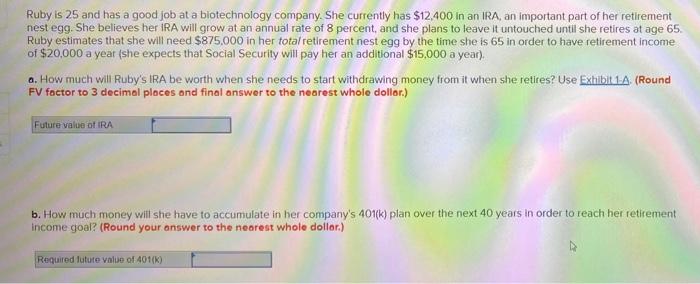

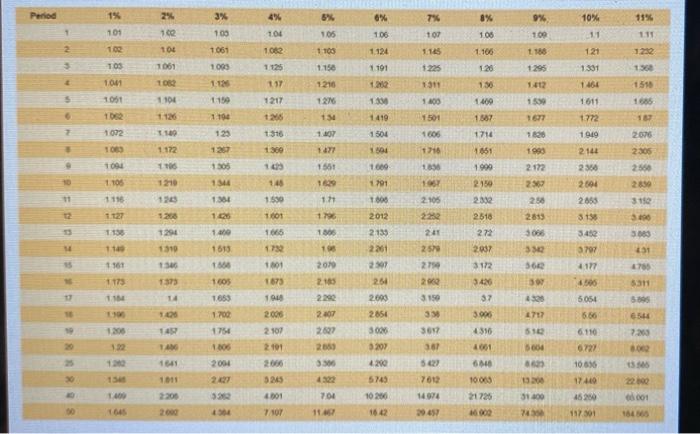

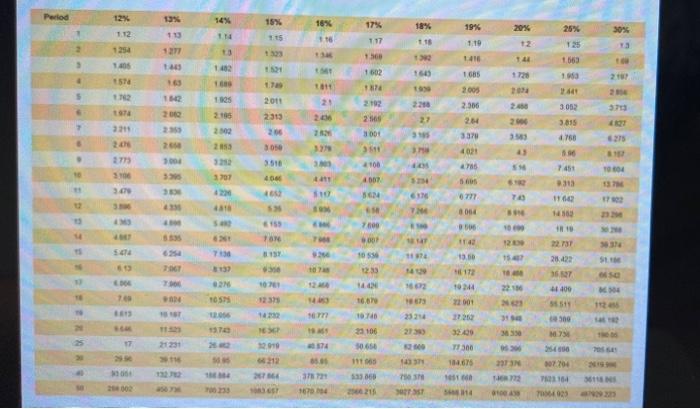

Ruby is 25 and has a good job at a biotechnology company. She currently has $12,400 in an IRA, an important part of her retirement nest egg. She believes her iRA will grow at an annual rate of 8 percent, and she plans to leave it untouched until she retires at age 65. Ruby estimates that she will need $875.000 in her total retirement nest egg by the time she is 65 in order to have retirement income of $20,000 a year (she expects that Social Security will pay her an additional $15,000 a year) a. How much will Ruby's IRA be worth when she needs to start withdrawing money from it when she retires? Use Exhibit 1A (Round FV foctor to 3 decimal places and final answer to the nearest whole dollor.) Future value of RA b. How much money will she have to accumulate in her company's 401(k) plan over the next 40 years in order to reach her retirement income goal? (Round your enswer to the nearest whole dollor) Required lutute value of 401(k) Period 1% 3% 5% 6% 79 8% 9% 15% 2% 1. 4% 104 10% 11 101 100 105 106 107 105 100 111 2 10 10 1062 1105 1124 1145 1.106 1186 121 1232 1125 1.158 1.301 1001 1052 1104 1061 1095 1125 1150 1194 1225 1311 TOS 1001 1051 1062 1002 150 1191 1.21 13 1510 17 1217 M 1216 1276 5 1600 1409 1599 1611 1685 154 1419 1387 1677 1772 16 1501 1606 2 100 123 1316 1102 1 504 1714 120 1919 3 1069 1 172 1257 1360 1471 TO 1716 1651 1990 2144 2075 2305 2.560 2859 1091 1106 1308 10 1561 1000 18 10 1.100 1210 1344 145 1791 10 200 2694 2855 1354 1. 2.105 1116 1127 2172 26 258 2813 3066 2 3158 1.00 100 1.550 1001 1065 1732 10 3150 390 5.000 1806 1800 2012 2139 2201 2507 1156 1140 241 1294 1510 3452 1613 19 25 2750 2150 2332 2518 272 2037 3172 3420 37 3.905 4356 33 36 3797 4.177 15 1961 15 2010 675 5311 1:37 1 BOS 673 254 300 4505 1173 11 14 2100 22 2007 5054 101 2.000 5.895 4300 717 1.00 6.86 654 120 3150 33 3612 361 2107 510 6.110 1.653 1700 1754 1000 2004 2. 7:26 12 14 2101 2000 2854 3026 207 4200 5745 10200 2627 2659 33 4322 461 5000 . 120 10.636 13 1641 1011 640 10003 oc 15 525 7612 17:40 22.09 0001 1.00 4001 704 14974 21726 31100 45250 137301 00 645 7107 11 9.49 0000 7 Period 12% SEL 15% 16% 17% 18% 19% 30% 113 1 1.15 16 117 118 1.12 1254 10 2 20% 12 1. 1:19 1410 1323 30 CHI 1402 360 1602 165 1.685 1720 20 . 54 1999 1 es 725 1 663 1950 141 3.052 5.85 4768 1811 20 2006 PARE 2013 2011 373 2315 2005 2.506 24 3370 2.450 2000 4 215 2.300 23 27 315 WE 20 300 311 2355 26 3.04 275 4021 95 3 2. 2773 30 3.0 . 100 FP VO 3707 300 3510 40 46 53 7451 318 116 0604 137 42 05 90 TTT 4007 64 EN 7600 4130 8064 CW US 5155 ON 10 10 10 00 11 7430 ra 13.00 105 1200 15. S CH 20 12.33 5139 2 SO 28,423 36 4400 10 18 22:36 172 1024 2000 14 16.6 10 105 60 1867 2514 123 14 55511 300 172 32.00 15 TOT 33100 50.654 M 3830 25 17 2010 7300 16 850 05 2313 11 123 710 378 200 POETIN CS IN 533060 2966216 2002 1678 14 SOT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts