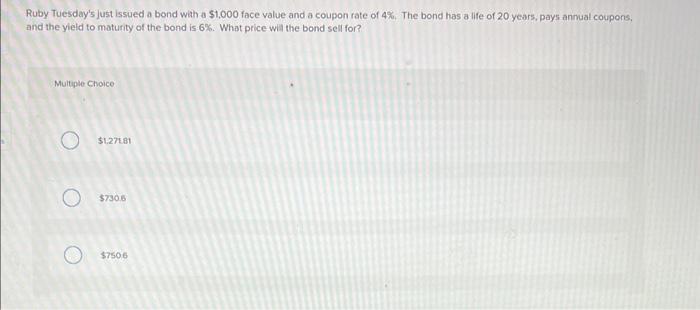

Question: Ruby Tuesday's just issued a bond with a $1,000 face value and a coupon rate of 4%. The bond has a life of 20 years,

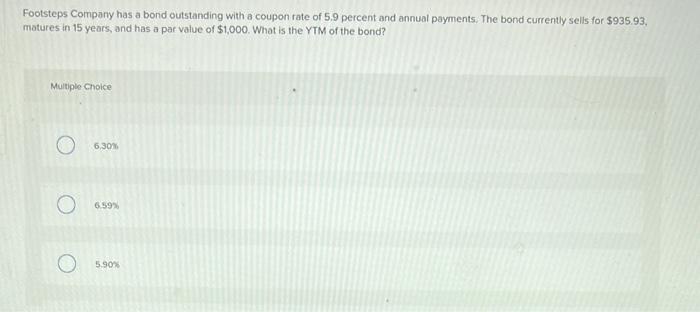

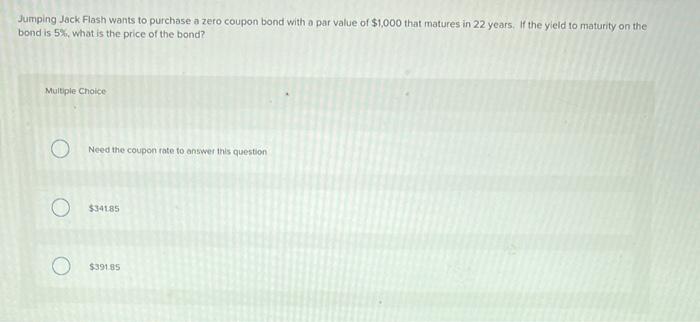

Ruby Tuesday's just issued a bond with a $1,000 face value and a coupon rate of 4%. The bond has a life of 20 years, pays annual coupons, and the yield to maturity of the bond is 6%. What price will the bond sell for? Multiple Choice 51,27881 $730.6 $7506 Footsteps Company has a bond outstanding with a coupon rate of 5.9 percent and annual payments. The bond currently sells for $935.93. matures in 15 years, and has a par value of $1,000. What is the YTM of the bond? Multiple croice 6.30x 6598 5.905 Jumping Jack Flash wants to purchase a zero coupon bond with a par value of $1,000 that matures in 22 years, If the yield to maturity on the bond is 5%, what is the price of the bond? Multiple Choice Need the coupon rate to answer this question $34185 $391.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts