Question: Ruff Motors needs to select an assembly line for producing their new SUV. They have two options: - Option A is a highly automated assembly

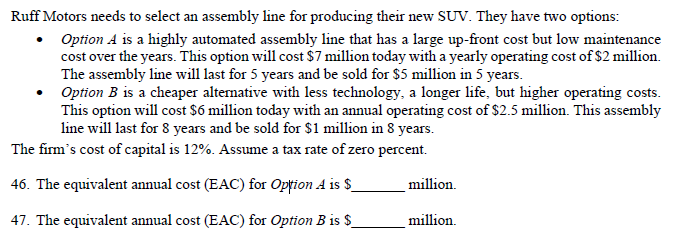

Ruff Motors needs to select an assembly line for producing their new SUV. They have two options: - Option A is a highly automated assembly line that has a large up-front cost but low maintenance cost over the years. This option will cost $7 million today with a yearly operating cost of $2 million. The assembly line will last for 5 years and be sold for $5 million in 5 years. - Option B is a cheaper alternative with less technology, a longer life, but higher operating costs. This option will cost $6 million today with an annual operating cost of $2.5 million. This assembly line will last for 8 years and be sold for $1 million in 8 years. The firm's cost of capital is 12%. Assume a tax rate of zero percent. 46. The equivalent annual cost (EAC) for Op tion A is $ million. 47. The equivalent annual cost (EAC) for Option B is $ million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts