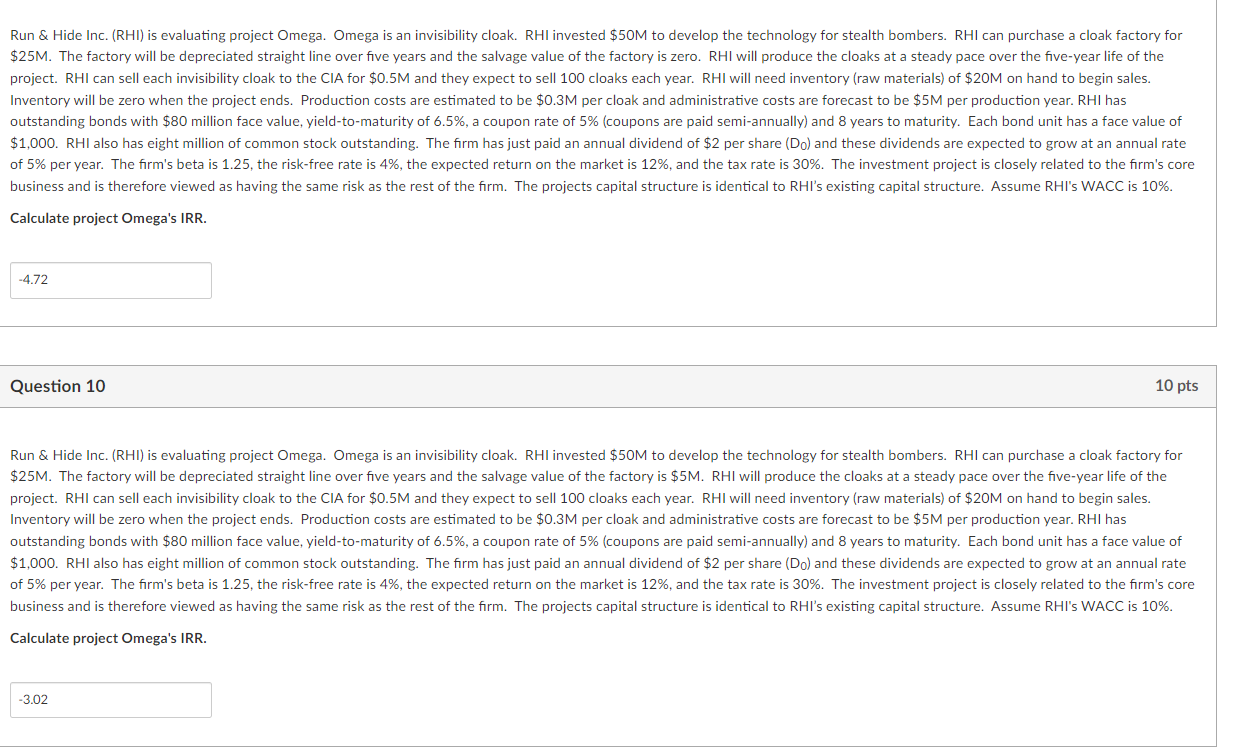

Question: Run & Hide Inc. ( RHI ) is evaluating project Omega. Omega is an invisibility cloak. RHI invested $ 5 0 M to develop the

Run & Hide Inc. RHI is evaluating project Omega. Omega is an invisibility cloak. RHI invested $ to develop the technology for stealth bombers. RHI can purchase a cloak factory for

$ The factory will be depreciated straight line over five years and the salvage value of the factory is zero. RHI will produce the cloaks at a steady pace over the fiveyear life of the

project. RHI can sell each invisibility cloak to the CIA for $ and they expect to sell cloaks each year. RHI will need inventory raw materials of $ on hand to begin sales.

Inventory will be zero when the project ends. Production costs are estimated to be $ per cloak and administrative costs are forecast to be $ per production year. RHI has

outstanding bonds with $ million face value, yieldtomaturity of a coupon rate of coupons are paid semiannually and years to maturity. Each bond unit has a face value of

$ RHI also has eight million of common stock outstanding. The firm has just paid an annual dividend of $ per share and these dividends are expected to grow at an annual rate

of per year. The firm's beta is the riskfree rate is the expected return on the market is and the tax rate is The investment project is closely related to the firm's core

business and is therefore viewed as having the same risk as the rest of the firm. The projects capital structure is identical to RHI's existing capital structure. Assume RHI's WACC is

Calculate project Omega's IRR.

Question

Run & Hide Inc. RHI is evaluating project Omega. Omega is an invisibility cloak. RHI invested $ to develop the technology for stealth bombers. RHI can purchase a cloak factory for

$ The factory will be depreciated straight line over five years and the salvage value of the factory is $ RHI will produce the cloaks at a steady pace over the fiveyear life of the

project. RHI can sell each invisibility cloak to the CIA for $ and they expect to sell cloaks each year. RHI will need inventory raw materials of $ on hand to begin sales.

Inventory will be zero when the project ends. Production costs are estimated to be $ per cloak and administrative costs are forecast to be $ per production year. RHI has

outstanding bonds with $ million face value, yieldtomaturity of a coupon rate of coupons are paid semiannually and years to maturity. Each bond unit has a face value of

$ RHI also has eight million of common stock outstanding. The firm has just paid an annual dividend of $ per share and these dividends are expected to grow at an annual rate

of per year. The firm's beta is the riskfree rate is the expected return on the market is and the tax rate is The investment project is closely related to the firm's core

business and is therefore viewed as having the same risk as the rest of the firm. The projects capital structure is identical to RHI's existing capital structure. Assume RHI's WACC is

Calculate project Omega's IRR.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock