Question: Rush please! Preparing Depreciation Schedules Using Various Depreciation Methods Prito in acquired equipment on January 1, 2020 at a cost of $60.000 hustiseitimated to have

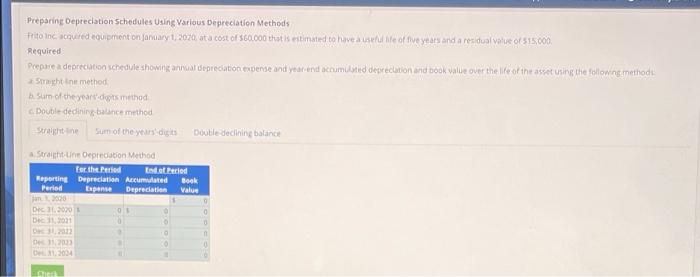

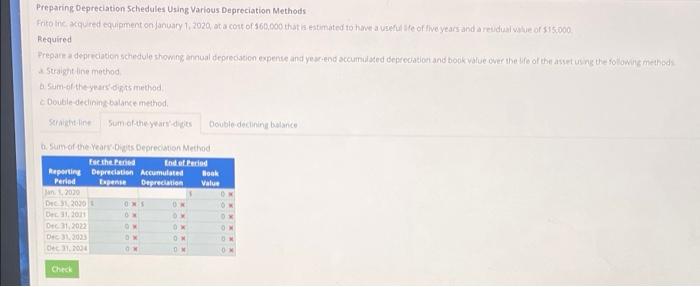

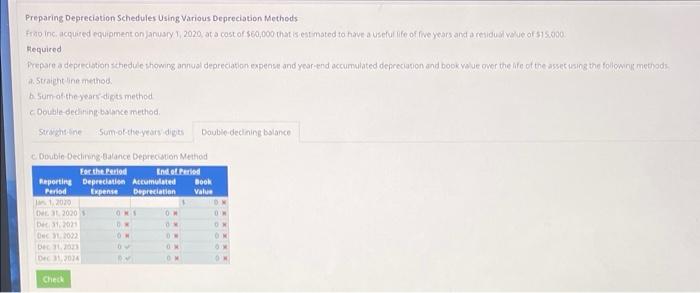

Preparing Depreciation Schedules Using Various Depreciation Methods Prito in acquired equipment on January 1, 2020 at a cost of $60.000 hustiseitimated to have a use of five years and a resdual value of 515.000 Required Prepare a depreciation schedule showing annual depreciation expense and year end rumusted dereclation and book value over the life of the asset using the following method Straight int method Sum of the year.dets method Double de dining balance method Sum of the years ago Double declining balance Straight line Deprecation Method Eer thered Ende Period Reporting Depreciation Accumulated Bock Period Expense Deprecation Value Dec20 08 2003 Preparing Depreciation Schedules Using Various Depreciation Methods Friton xured equipment on January 1, 2020, at a cost of 560,000 that is estimated to have a better live years and area of 515.000 Required Prepare a depreciation schedule showing annual deprecation expense and you are accumulated deprecation and book value over the tool the assets the followmethods Straight line method Sum of the years op method Double declinin balance method Sri Sum of the yards Double declining balance Sum of the Yearts Depreciation Method Esthee Endot Pacied Reporting Depreciation Accumulated Book Period Depreciation Value 2020 DO 2020 Oxs 02 DE 2011 DEC312022 D Dec 31.30 B Dec.2001 O OM Check Preparing Depreciation Schedules Using Various Depreciation Methods Fro in acquired equipment on January 1, 2020 at a cost of $60,000 that is estimated to have a useful life of five years and a rede 15.000 Hequired Prepare a depreciation schedule showing annual depreciation expose and year-end accumulated depreciation and book your over the We of the assessing the following methods Straight line method Sum of the years dits method Double-decinin balance method Sucheine Sum of the years dits Double declining balance C Double Declining balance Depreciation Method Eor the Period need Reporting Depreciation Accumulated Book Period Expense Depreciation Value 2030 2020 OR OW Det D D3014 Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts