Rustenburg Ltd became a subsidiary of Midrand Ltd on 2 January 20.23. consider the carrying amount...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

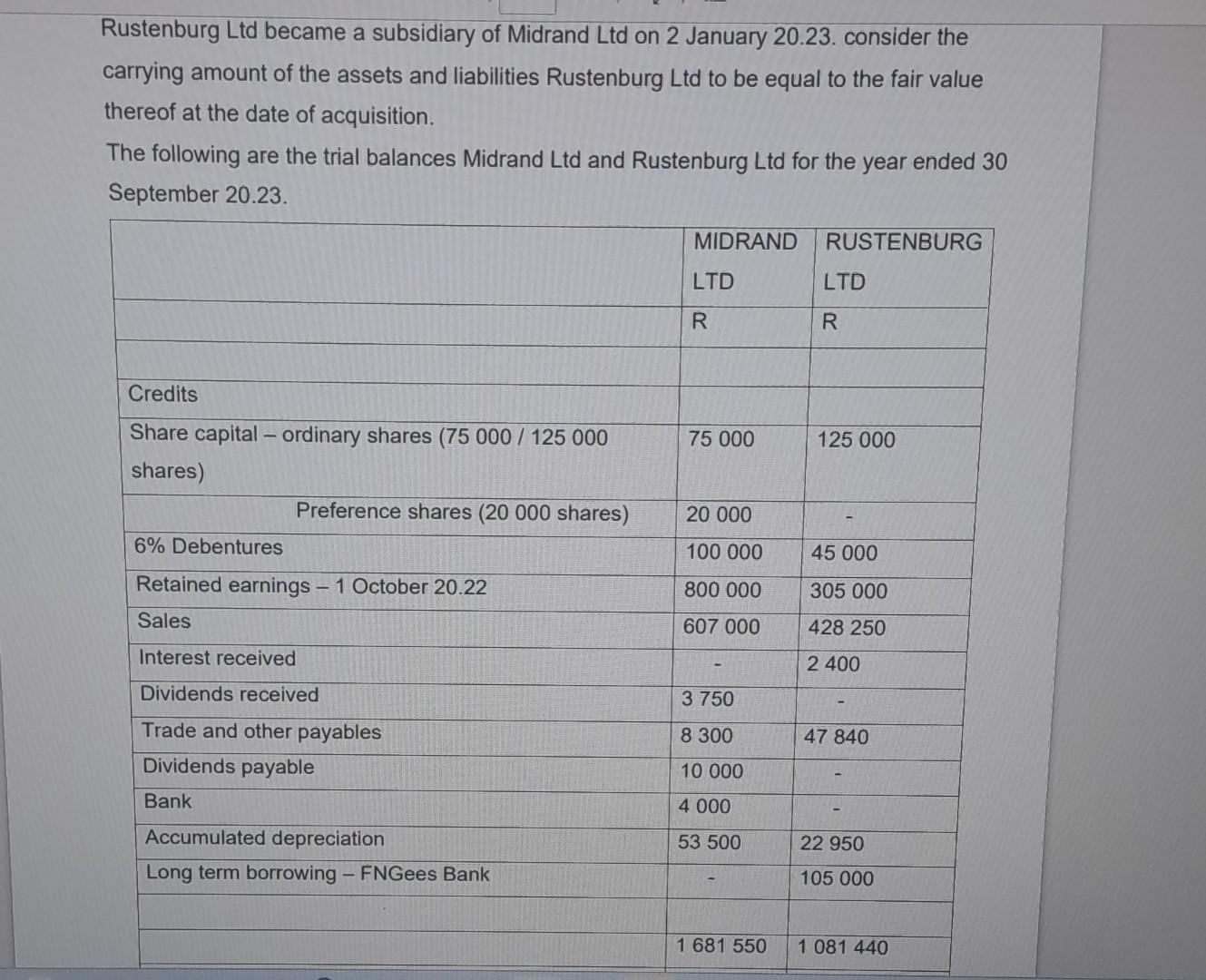

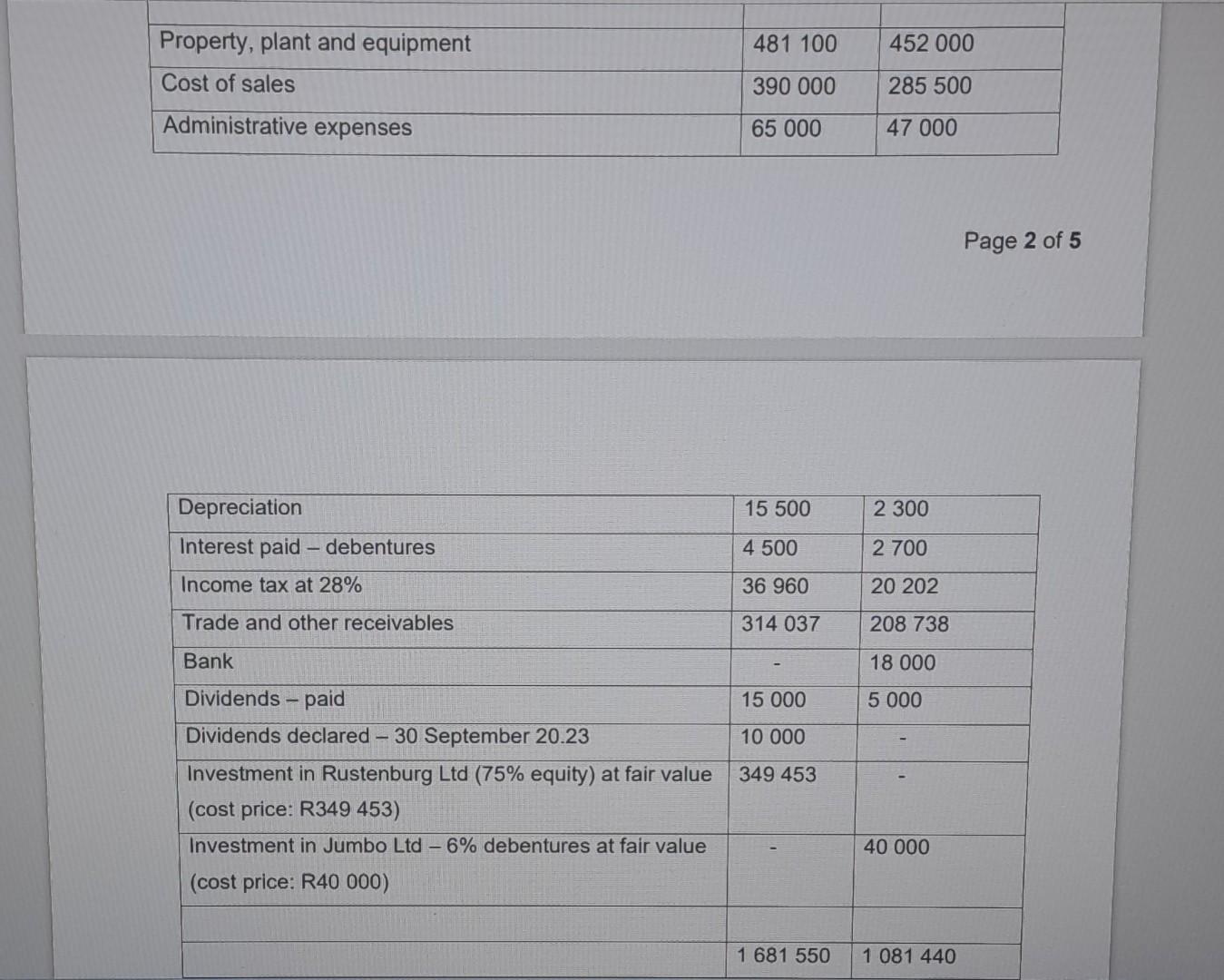

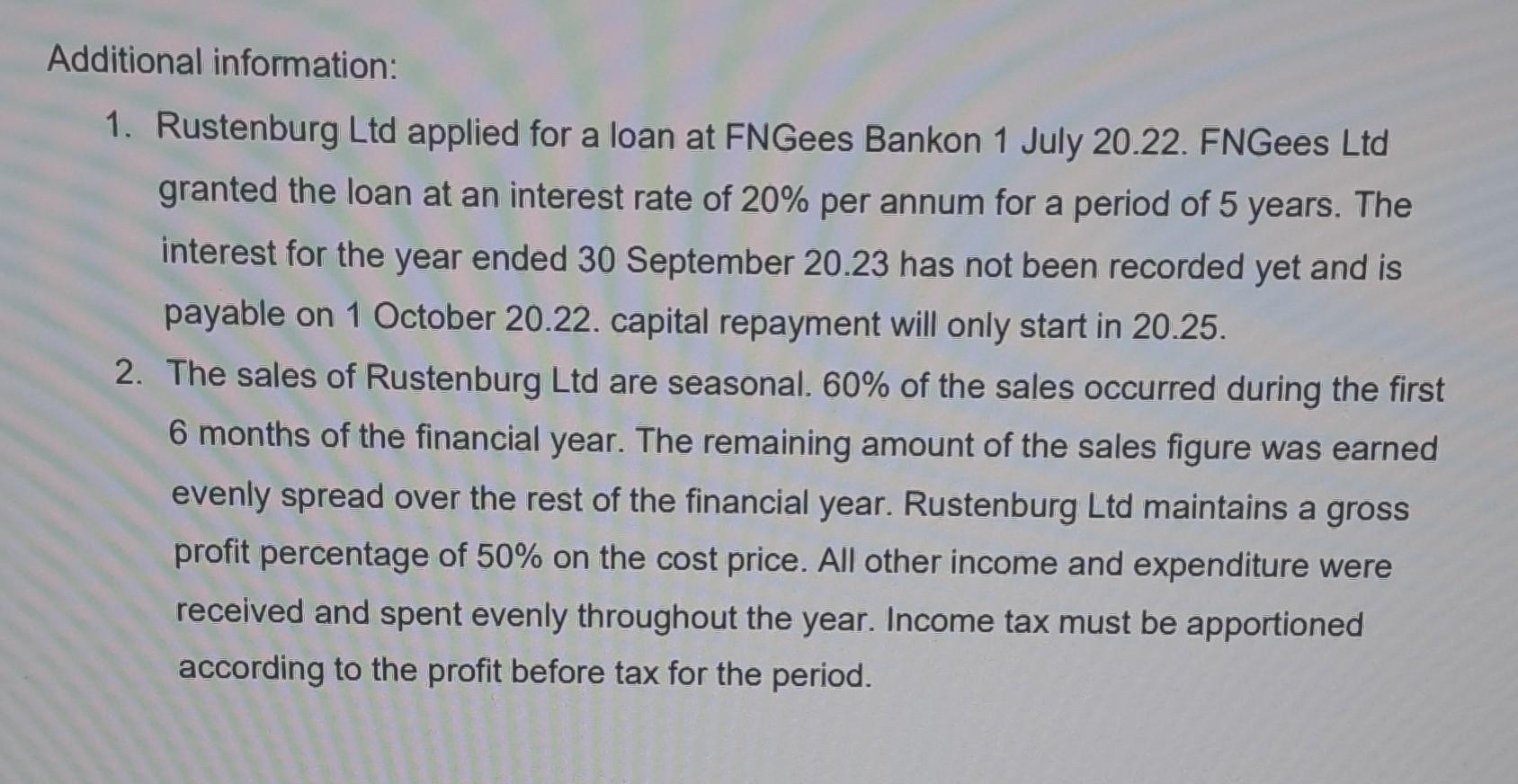

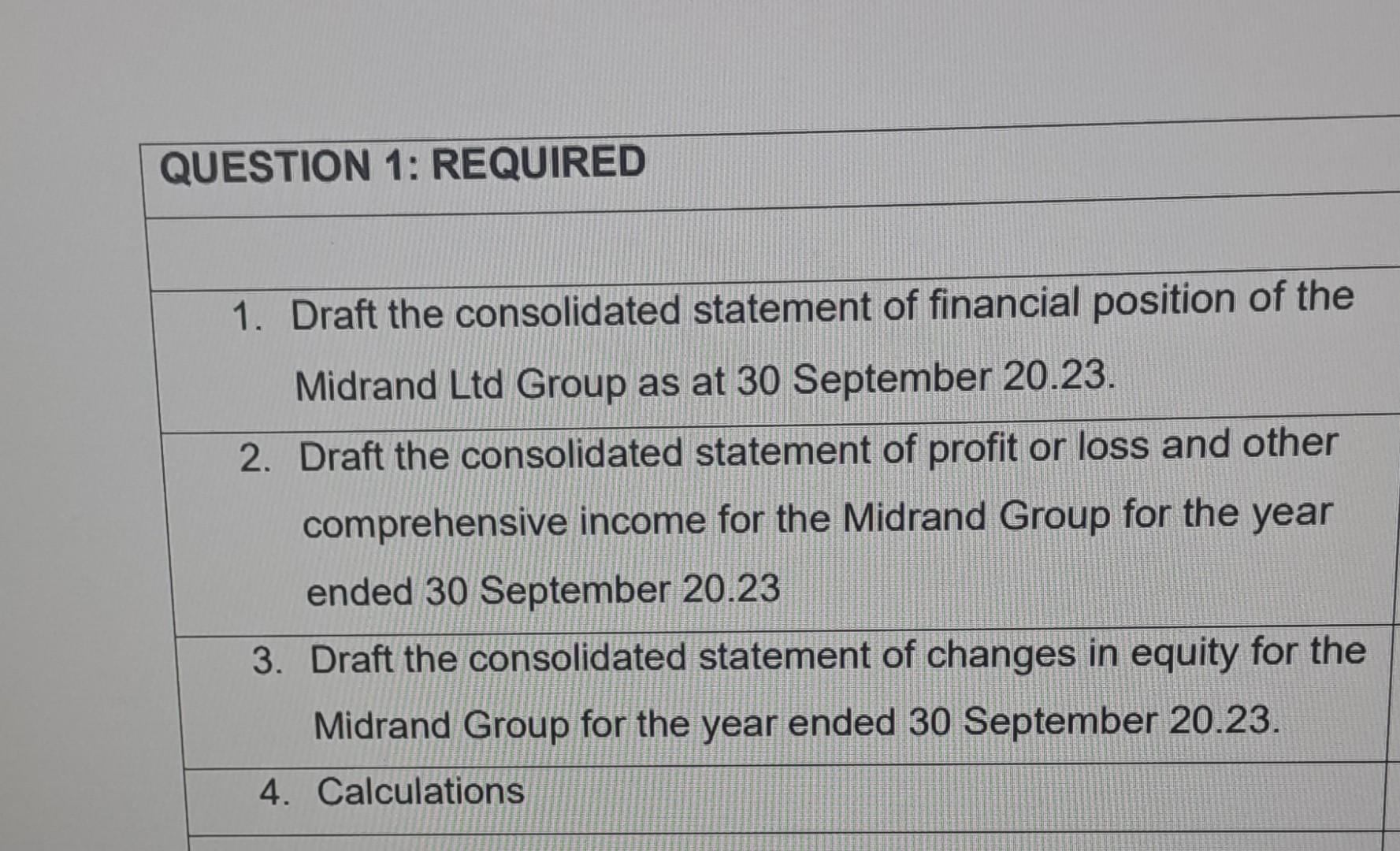

Rustenburg Ltd became a subsidiary of Midrand Ltd on 2 January 20.23. consider the carrying amount of the assets and liabilities Rustenburg Ltd to be equal to the fair value thereof at the date of acquisition. The following are the trial balances Midrand Ltd and Rustenburg Ltd for the year ended 30 September 20.23. Credits Share capital - ordinary shares (75 000 / 125 000 shares) Preference shares (20 000 shares) 6% Debentures Retained earnings - 1 October 20.22 Sales Interest received Dividends received Trade and other payables Dividends payable Bank Accumulated depreciation Long term borrowing - FNGees Bank MIDRAND LTD R 75 000 20 000 100 000 800 000 607 000 3 750 8 300 10 000 4 000 53 500 1 681 550 RUSTENBURG LTD R 125 000 45 000 305 000 428 250 2 400 47 840 22 950 105 000 1 081 440 Property, plant and equipment Cost of sales Administrative expenses Depreciation Interest paid - debentures Income tax at 28% Trade and other receivables Bank Dividends-paid Dividends declared - 30 September 20.23 Investment in Rustenburg Ltd (75% equity) at fair value (cost price: R349 453) Investment in Jumbo Ltd - 6% debentures at fair value (cost price: R40 000) 481 100 390 000 65 000 15 500 4 500 36 960 314 037 15 000 10 000 349 453 1 681 550 452 000 285 500 47 000 2 300 2 700 20 202 208 738 18 000 5 000 40 000 1 081 440 Page 2 of 5 Additional information: 1. Rustenburg Ltd applied for a loan at FNGees Bankon 1 July 20.22. FNGees Ltd granted the loan at an interest rate of 20% per annum for a period of 5 years. The interest for the year ended 30 September 20.23 has not been recorded yet and is payable on 1 October 20.22. capital repayment will only start in 20.25. 2. The sales of Rustenburg Ltd are seasonal. 60% of the sales occurred during the first 6 months of the financial year. The remaining amount of the sales figure was earned evenly spread over the rest of the financial year. Rustenburg Ltd maintains a gross profit percentage of 50% on the cost price. All other income and expenditure were received and spent evenly throughout the year. Income tax must be apportioned according to the profit before tax for the period. QUESTION 1: REQUIRED 1. Draft the consolidated statement of financial position of the Midrand Ltd Group as at 30 September 20.23. 2. Draft the consolidated statement of profit or loss and other comprehensive income for the Midrand Group for the year ended 30 September 20.23 3. Draft the consolidated statement of changes in equity for the Midrand Group for the year ended 30 September 20.23. 4. Calculations Rustenburg Ltd became a subsidiary of Midrand Ltd on 2 January 20.23. consider the carrying amount of the assets and liabilities Rustenburg Ltd to be equal to the fair value thereof at the date of acquisition. The following are the trial balances Midrand Ltd and Rustenburg Ltd for the year ended 30 September 20.23. Credits Share capital - ordinary shares (75 000 / 125 000 shares) Preference shares (20 000 shares) 6% Debentures Retained earnings - 1 October 20.22 Sales Interest received Dividends received Trade and other payables Dividends payable Bank Accumulated depreciation Long term borrowing - FNGees Bank MIDRAND LTD R 75 000 20 000 100 000 800 000 607 000 3 750 8 300 10 000 4 000 53 500 1 681 550 RUSTENBURG LTD R 125 000 45 000 305 000 428 250 2 400 47 840 22 950 105 000 1 081 440 Property, plant and equipment Cost of sales Administrative expenses Depreciation Interest paid - debentures Income tax at 28% Trade and other receivables Bank Dividends-paid Dividends declared - 30 September 20.23 Investment in Rustenburg Ltd (75% equity) at fair value (cost price: R349 453) Investment in Jumbo Ltd - 6% debentures at fair value (cost price: R40 000) 481 100 390 000 65 000 15 500 4 500 36 960 314 037 15 000 10 000 349 453 1 681 550 452 000 285 500 47 000 2 300 2 700 20 202 208 738 18 000 5 000 40 000 1 081 440 Page 2 of 5 Additional information: 1. Rustenburg Ltd applied for a loan at FNGees Bankon 1 July 20.22. FNGees Ltd granted the loan at an interest rate of 20% per annum for a period of 5 years. The interest for the year ended 30 September 20.23 has not been recorded yet and is payable on 1 October 20.22. capital repayment will only start in 20.25. 2. The sales of Rustenburg Ltd are seasonal. 60% of the sales occurred during the first 6 months of the financial year. The remaining amount of the sales figure was earned evenly spread over the rest of the financial year. Rustenburg Ltd maintains a gross profit percentage of 50% on the cost price. All other income and expenditure were received and spent evenly throughout the year. Income tax must be apportioned according to the profit before tax for the period. QUESTION 1: REQUIRED 1. Draft the consolidated statement of financial position of the Midrand Ltd Group as at 30 September 20.23. 2. Draft the consolidated statement of profit or loss and other comprehensive income for the Midrand Group for the year ended 30 September 20.23 3. Draft the consolidated statement of changes in equity for the Midrand Group for the year ended 30 September 20.23. 4. Calculations

Expert Answer:

Answer rating: 100% (QA)

Certainly lets prepare the consolidated financial statements for Midrand Ltd Group as at 30 September 2023 Consolidated Statement of Financial Position as at 30 September 2023 in R plaintext Assets Cu... View the full answer

Related Book For

Posted Date:

Students also viewed these accounting questions

-

Suppose you are interested in how exercising impacts a person's mental health. You have access to a dataset of 100,000 observations which includes the following variables: 1 mentalhealth: mental...

-

Question 1 This question has two parts, (A) and (B). Answer both parts. 100% Liverpool plc is a company that manufactures a number of different types of electrical goods and has a year end of 31...

-

V4x - - 4 Find lim by rewriting the fraction first. 4x- - 16 ()(4,0) 4x - # 16 V4x - - 4 lim 4x- - 16 ()- (4,0) 4x- # 16

-

The following summarized statement of profit or loss has been extracted from the financial statements of Gwembe Mining Corporation, a Zambian resident company which engaged in open cast mining...

-

The trouble with the error estimates is that it is often very difficult to compute four derivatives and obtain a good upper bound for by K | f (4)(x) | hand. But computer algebra systems have no...

-

A P/E multiple could be high relative to the S&P 500 Index because its high growth rate justifies it. You notice a stock that has an assumed growth rate of 5.43% with a dividend payout ratio of 64.9%...

-

What are the factors that shape software modeling?

-

Using the data presented in Exercise 8-18, journalize the entry or entries that should be made by the company.

-

In what category does the following question best fit? What drinks does Dunkin sell?

-

Ben Rawiller, a resident taxpayer operates an electrical goods store. During the 2021/22 tax year, Ben had the following transactions: Sales Purchases of Trading Stock Stock-1 July 2020 $ 2,927,800...

-

Consider a dataset {(x,y)} where x = [xx] and y) = {0,1}, which is shown in the figure below. Suppose we have trained a support vector machine (SVM) on the dataset, which has the decision boundary w...

-

What is the burden of proof?

-

What standard of review are the courts to apply?

-

While a student with severe impairments may have many costs paid by an educational agency until the student graduates from high school, what happens at that point when there is not the same...

-

What do state education statutes relating to special education add to the IDEA? Why doesnt the IDEA cover these issues?

-

Why are the procedural protections of the law important? Do you think the goals of the law that were noted in this chapter could be met without these protections? Why or why not?

-

The Westmont Factory Ltd. manufactures high-end mountain bicycles (MTB) of many different sizes and types. The company employs 55 employees, all paid on an hourly basis. Employees fill in time sheets...

-

Given find the value of k. es 1 e kx dx = 1 4'

-

How are costs associated with the issuance of bonds payable accounted for?

-

Which of the following best explains how a translation loss arises when the temporal method of translation is used to translate the foreign currency financial statements of a foreign subsidiary? a....

-

What is treaty shopping?

-

Input information from the SBA Personal Financial Statements given to Sharptop Bank into a spreadsheet. a. Separate personal items (e.g., residence) from business items (e.g., inventory). b....

-

Compare your recalculated ending inventory to that given to Sharptop Bank and to Southern Appalachian Insurance. Is either estimated ending inventory materially different from that reported on the...

-

What accuracy certifications on the tax return and bank financial statement address providing materially inaccurate information?

Study smarter with the SolutionInn App