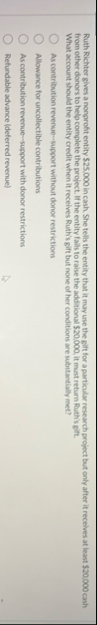

Question: Ruth Richter gives a nonorofit entity $ 2 5 , 0 0 0 in cash. She tells the entity that it may use the gift

Ruth Richter gives a nonorofit entity $ in cash. She tells the entity that it may use the gift for a particular research project but only after it recelves at least $ cash from other donors to help complete the profect. If the entity fails to raise the additional $ it must return Ruth's gift.

What account should the entity credit when it receives Ruth's gift but none of her conditions are substantially met?

As contribution revenuesupport without donor restrictions

Allowance for uncollect ible contributions

As enverbation revembesumport with donoo restrictions

Refundable advance deferred revenue

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock