Question: RWP10-4 (Static) Comparative Analysis Continuing Case - American Eagle vs. The Buckle Financial information for American Eagle is presented in Appendix. A at the end

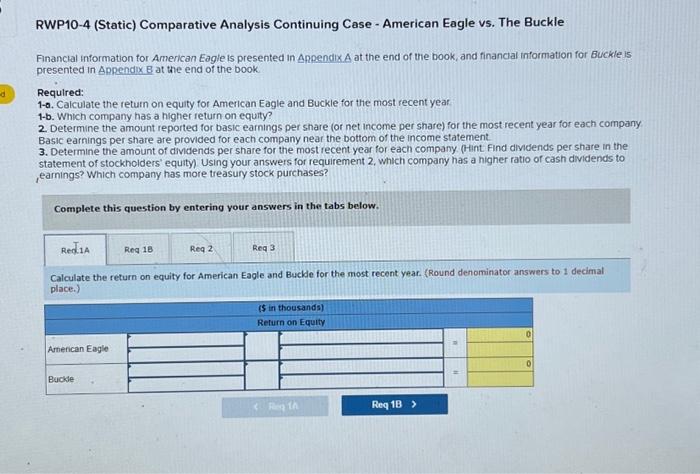

RWP10-4 (Static) Comparative Analysis Continuing Case - American Eagle vs. The Buckle Financial information for American Eagle is presented in Appendix. A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1-a. Calculate the return on equity for American Eagle and Buckle for the most recent year 1-b. Which company has a higher return on equity? 2. Determine the amount reported for basic earnings per share (or net income per share) for the most recent year for each company Basic earnings per share are provided for each company near the bottom of the income statement. 3. Determine the amount of dividends per share for the most recent year for each company. (Hint. Find dividends per share in the statement of stockholders' equity) Using your answers for requirement 2, which company has a higher ratio of cash dividends to , earnings? Which company has more treasury stock purchases? Complete this question by entering your answers in the tabs below. Calculate the return on equity for American Eagle and Buckle for the most recont year. (Round denominator answers to 1 decimal Dlace

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts