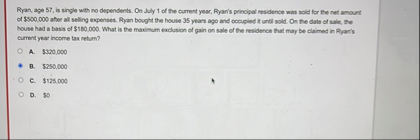

Question: Ryan, age 5 7 , is single wth no dependents. On July 1 of the current year, Ryan's principal residence was sold for the net

Ryan, age is single wth no dependents. On July of the current year, Ryan's principal residence was sold for the net anourt of $ aher all seling expenses. Pyan bought the house yours ago and cocopied it untll sold. On the date of sale, the house had a basis of $ What is the maximum exclusion of gain on sale of the residence that mary be clamed in Ryarts current your income tax rehum?

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock