Question: ryin 2 Explain how Fnplar to e revised to improve its eftectiveness. lems that appear to exist in Ferguson&So L. kdentify the problems that n

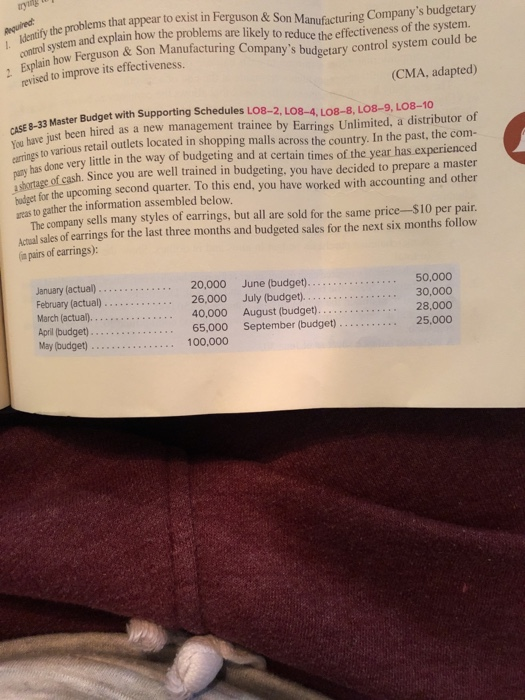

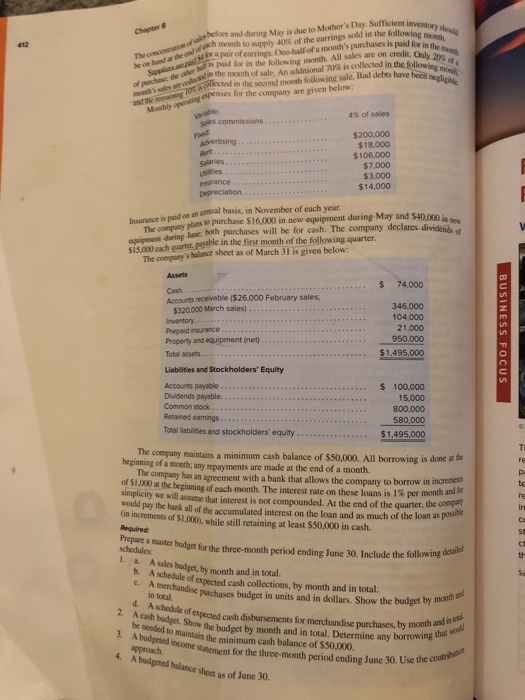

ryin 2 Explain how Fnplar to e revised to improve its eftectiveness. lems that appear to exist in Ferguson&So L. kdentify the problems that n Manufacturing Company's budgetary n system and explain how the problems are likely to reduce the effectiveness of the system. n how Ferguson & Son Manufacturing Company's budgetary control system could be (CMA, adapted) Master Budget with Supporting Schedules LO8-2, LO8-4, LO8-8, LO8-9, LO8-10 hve iust been hired as a new management trainee by Earrings Unlimited, a distributor of arings to various retail outlets located in shopping malls across the country. In the past, the com- has done very little in the way of budgeting and at certain times of the year has.experienced of cash. Since you are well trained in budgeting, you have decided to prepare a master hodget for the upcoming second quarter. lo this end, you have worked with accounting and other ras to gather the information assembled below The company sells many styles of earrings, but all are sold for the same price-$10 per pair Actual sales of earrings for the last three months and budgeted sales for the next six months follow in pairs of carrings): February (actual) April (budget).. May (budget) 30,000 28,000 .25,000 65,000 September (budget) 100,000 .. d sales heore and during May is due to Mother's Day, Sufficient J dan month to supply 40% of the earrings sold in the fol hr al is puid for in the following month. All sales are on credit. Only inventory shoudd 412 The concernant at the cry sgi fr a pair of earrings Ooo-balfof a month's purchases is paid for in ofhe 21% of S., the month of sale An additional % is collected in t ahor selkected in the second month follow ing sale. Bad debts have beenl rrating peases for the company are given below 4% of sales sales commissions $200,000 $18,000 $106,000 $7,000 $3,000 14,000 on an annual basis, in November of each year Insurance is paid equipment daring June: oth purchases will be for cash. The company declares dividen Siscoo cach quarter,pugable in the first month of the following quarter. The company plans so purchase $16,000 in new equipment during May and $40,000 The company's balance sheet as of March 31 is given below: $ 74,000 Cash Accounts receivable ($26.000 February sales 346,000 104,000 21,000 320.000 March sales) Prepaid insurance Property and equipment (net) Total assets Liabilities and Stockholders' Equity Accounts payable Dividends payable. Common stock. Retained earnings.. . $ 100,000 15,000 800,000 580,000 $1,495,000 Total liabilities and stockholders' equity he company maintains a minimum cash balance of $50,000. All borrowing is done at the beginning of a month any repayments are made at the end of a month. The compary has an agreement with a bank that allows the company to borrow in i would pay the bank all of the accumulated interest on the loan and as much of the loan as posie er mer bulgtfo he thoeriod ending June 30. Include the followingda of $1.00 at the beginning of each month. The interest rate on these loans is 1% per simplicity we will assume that interest is not compounded. At the end of the quarter, the d month and ir fin increments of $1,000), while still retaining at least $50,000 in cash. schedules: . a A sales budget, by month and in total. b. A schedule of expected purchases budget in units and in dollars. Show the budget by moi d. A schedule of expected 2 espested cash disbursements for merchandise purchases, by mon 3. A budgetedmum cash balance of $$0,000. 4. A budgeted balance sheet as of June 30. A cash budget. Show be needed to an the budget by month and in total. Determine any borrowing tha by income talement for the three-month period ending June 30. Use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts