Question: #'s 3, 4, 5 & 6 Question 3 5 pts A company's current sales is $125 million. If sales grow at 8%, what will they

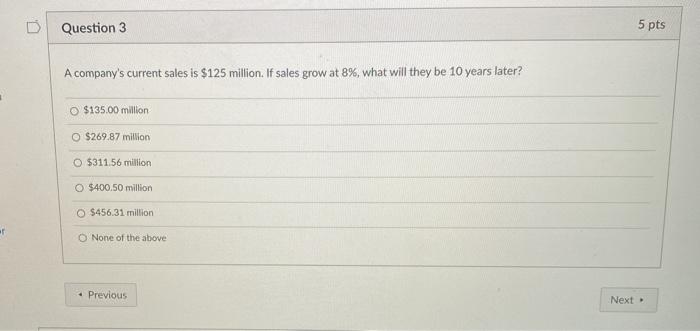

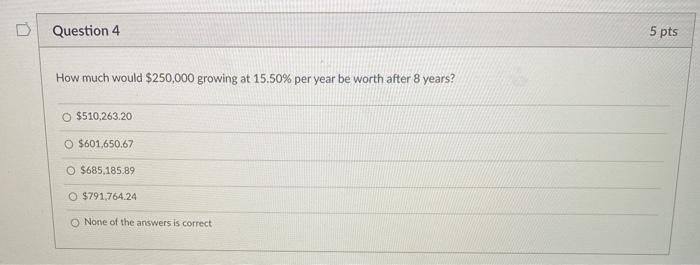

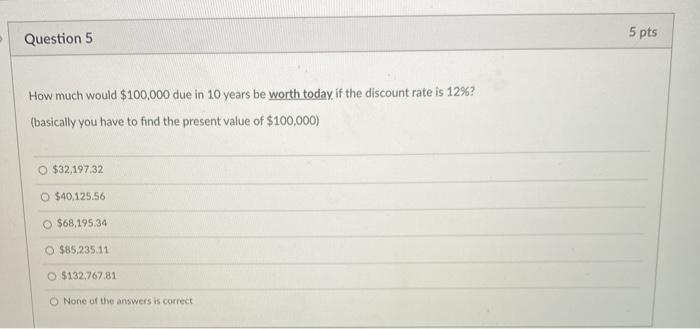

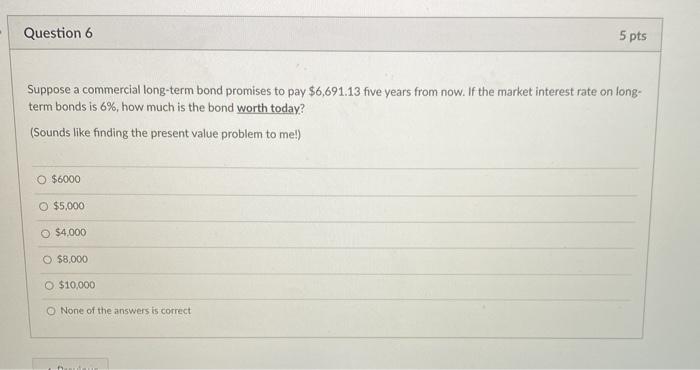

Question 3 5 pts A company's current sales is $125 million. If sales grow at 8%, what will they be 10 years later? $135.00 million O $269.87 million O $311.56 million O $400.50 million $456.31 million or None of the above Previous Next Question 4 5 pts How much would $250,000 growing at 15.50% per year be worth after 8 years? $510.263.20 O $601,650.67 O $685,185.89 O $791764.24 None of the answers is correct Question 5 5 pts How much would $100,000 due in 10 years be worth today if the discount rate is 12%? (basically you have to find the present value of $100,000) O $32,197.32 O $40.125.56 O $68,195,34 O $85,235.11 O $132.767.81 O None of the answers is correct Question 6 5 pts Suppose a commercial long-term bond promises to pay $6,691.13 five years from now. If the market interest rate on long- term bonds is 6%, how much is the bond worth today? (Sounds like finding the present value problem to me!) O $6000 O $5,000 O $4,000 O $8,000 O $10,000 None of the answers is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts