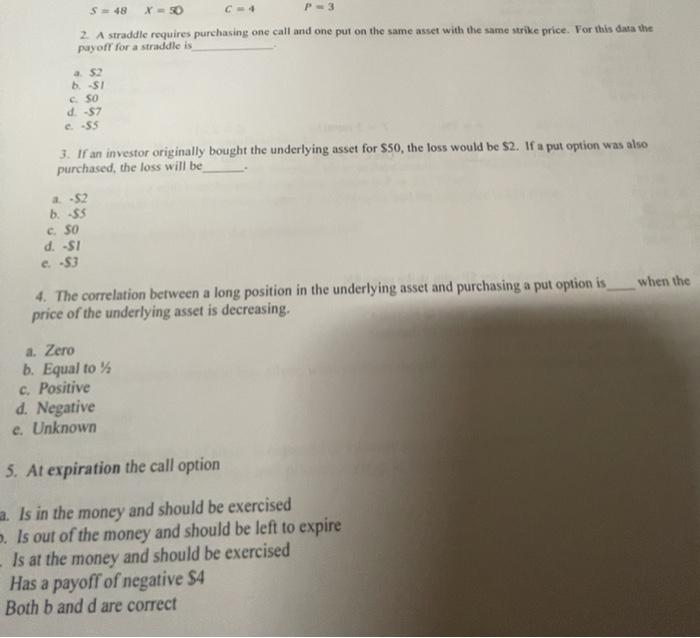

Question: S = 48 X= 50 C=4 P=3 2. A straddle requires purchasing one call and one put on the same asset with the same strike

S = 48 X= 50 C=4 P=3 2. A straddle requires purchasing one call and one put on the same asset with the same strike price. For this data the payoff for a straddle is 4. 52 b. -Sl e. -$5 3. If an investor originally bought the underlying asset for $50, the loss would be $2. If a put option was also purchased, the loss will be a. -$2 b. -$5 c. SO d. -$1 c. -$3 4. The correlation between a long position in the underlying asset and purchasing a put option is price of the underlying asset is decreasing. when the a. Zero b. Equal to c. Positive d. Negative e. Unknown 5. At expiration the call option a. Is in the money and should be exercised D. Is out of the money and should be left to expire Is at the money and should be exercised Has a payoff of negative $4 Both b and d are correct c. 50 d. -$7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts