Question: S and D formed a partnership by converting both their sole proprietorship business on January 1,2020. Cash and non-cash assets are to be contributed for

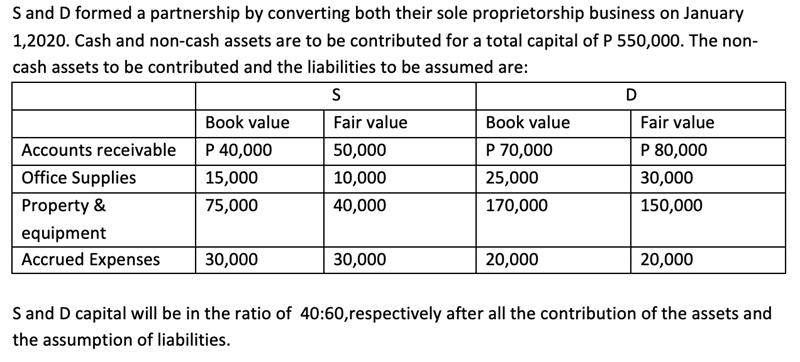

S and D formed a partnership by converting both their sole proprietorship business on January 1,2020. Cash and non-cash assets are to be contributed for a total capital of P 550,000. The non- cash assets to be contributed and the liabilities to be assumed are: S D Book value Fair value Book value Fair value Accounts receivable P 40,000 50,000 P 70,000 P 80,000 Office Supplies 15,000 10,000 25,000 30,000 Property & 75,000 40,000 170,000 150,000 equipment Accrued Expenses 30,000 30,000 20,000 20,000 S and D capital will be in the ratio of 40:60, respectively after all the contribution of the assets and the assumption of liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts