Question: s ballel It is due Today, at 11:00 AM ADD A COMMENT This examen 4 de 4 is included in your final grade and is

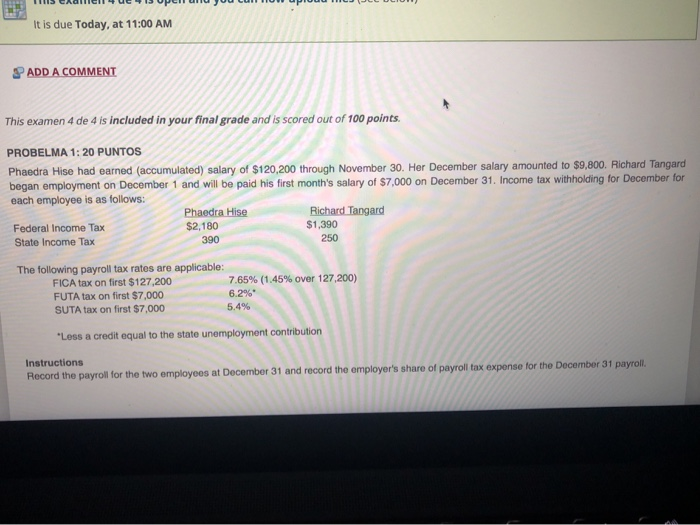

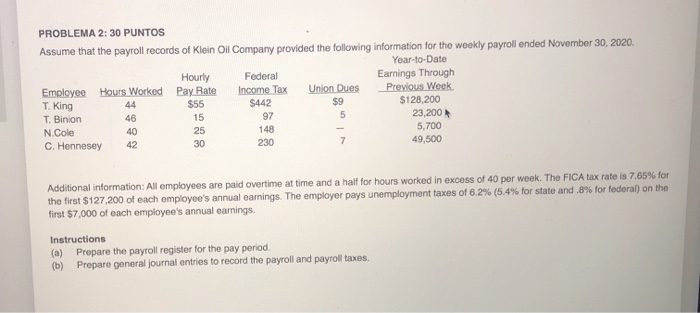

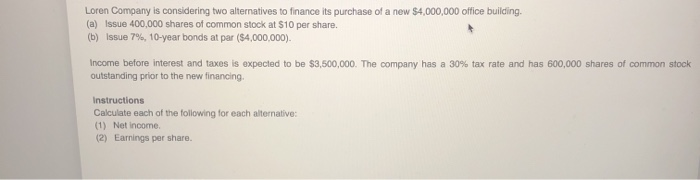

s ballel It is due Today, at 11:00 AM ADD A COMMENT This examen 4 de 4 is included in your final grade and is scored out of 100 points. PROBELMA 1: 20 PUNTOS Phaedra Hise had earned (accumulated) salary of $120,200 through November 30. Her December salary amounted to $9,800. Richard Tangard began employment on December 1 and will be paid his first month's salary of $7,000 on December 31. Income tax withholding for December for each employee is as follows: Phaedra Hise Richard Tangard Federal Income Tax $2,180 $1,390 State Income Tax 390 250 The following payroll tax rates are applicable: FICA tax on first $127.200 7.65% (1.45% over 127,200) FUTA tax on first $7,000 6.26" SUTA tax on first $7,000 5.4% "Less a credit equal to the state unemployment contribution Instructions Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll PROBLEMA 2:30 PUNTOS Assume that the payroll records of Klein Oil Company provided the following information for the wookly payroll ended November 30, 2020 Year-to-Date Hourly Federal Earnings Through Employee Hours Worked Pay Rate Income Tax Union Dues Previous Week T. King 44 $55 $442 $128.200 T. Binion 46 15 97 23,200 N. Cole 25 148 5,700 C. Hennesey 42 230 49,500 30 Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $127.200 of each employee's annual earnings. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings. Instructions (a) Prepare the payroll register for the pay period. (b) Prepare general journal entries to record the payroll and payroll taxes. Loren Company is considering two alternatives to finance its purchase of a new $4,000,000 office building. (a) Issue 400,000 shares of common stock at $10 per share. (b) Issue 7%, 10-year bonds at par ($4,000,000). Income before interest and taxes is expected to be $3,500,000. The company has a 30% tax rate and has 600,000 shares of common stock outstanding prior to the new financing. Instructions Calculate each of the following for each alternative: (1) Net income (2) Earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts