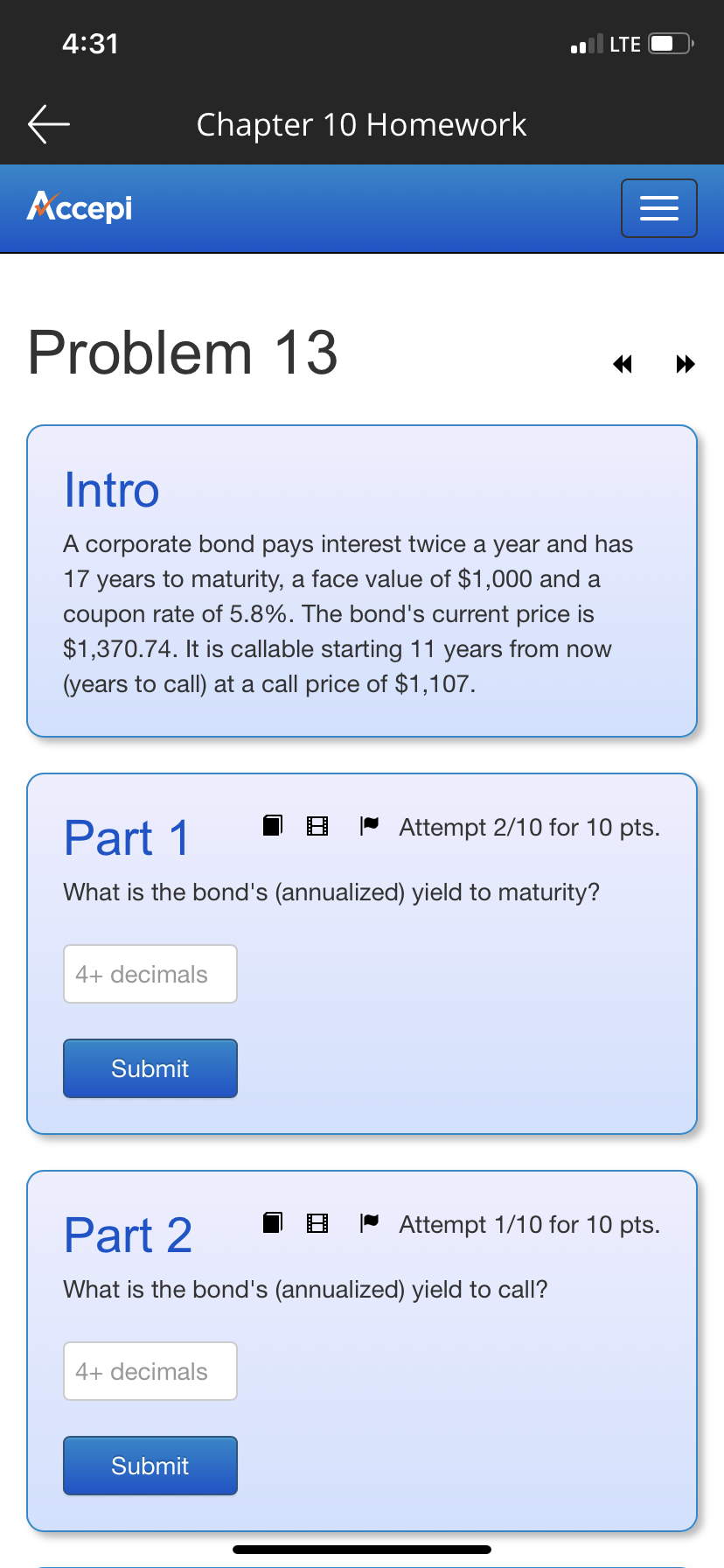

Question: S Chapter 10 Homework Accepi Problem 13 Intro A corporate bond pays interest twice a year and has 17 years to maturity, a face value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts