Question: S. Computing and interpreting the degree of operating leverage (DOL) It is December 31. Last year, Aberdeen Petroleum Refiners Corp. had sales of $8,000,000, and

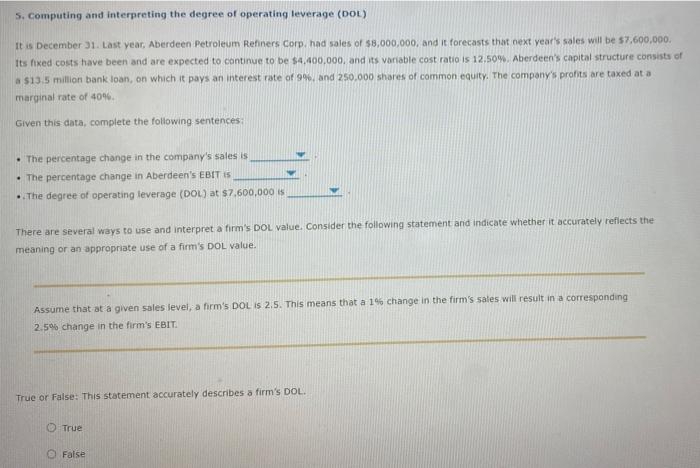

S. Computing and interpreting the degree of operating leverage (DOL) It is December 31. Last year, Aberdeen Petroleum Refiners Corp. had sales of $8,000,000, and it forecasts that next year's sales will be 57.600,000 its fixed costs have been and are expected to continue to be $4.400,000, and its variable cost ratio is 12,50%. Aberdeen's capital structure consists of a $13.5 million bank loan, on which it pays an interest rate of 99 and 250.000 shares of common equity. The company's profits are taxed at a marginal rate of 40%. Given this data, complete the following sentences The percentage change in the company's sales is The percentage change in Aberdeen's EBIT 15 ..The degree of operating leverage (DOL) at $7.600,000 V There are several ways to use and interpret a firm's DOL value. Consider the following statement and indicate whether it accurately reflects the meaning or an appropriate use of a firm's DOL value. Assume that at a given sales level, a firm's DOL IS 2.5. This means that a 1% change in the firm's sales will result in a corresponding 2.5% change in the firm's EBIT True or False. This statement accurately describes a firm's DOL. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts