Question: S E . General Calibri 12 AA B IU..A.A. Wrap Text Merge & Center - ste $ -% 9 ipboard Font Number for : *

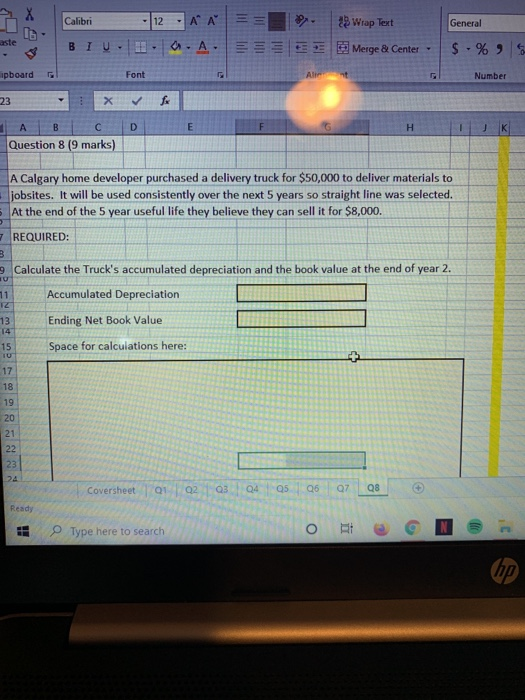

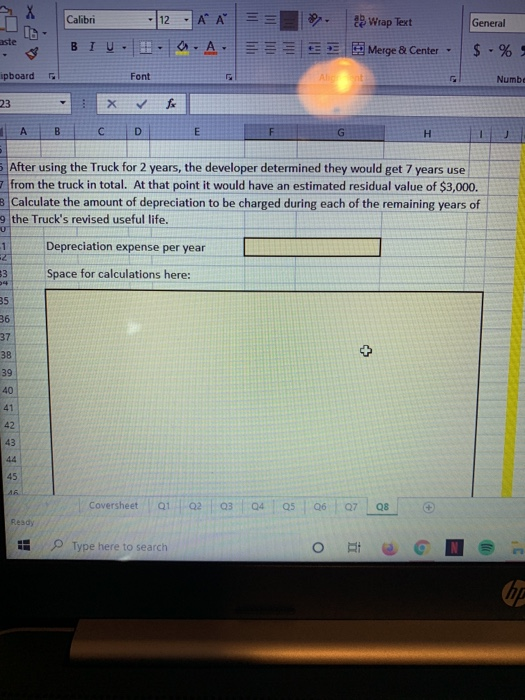

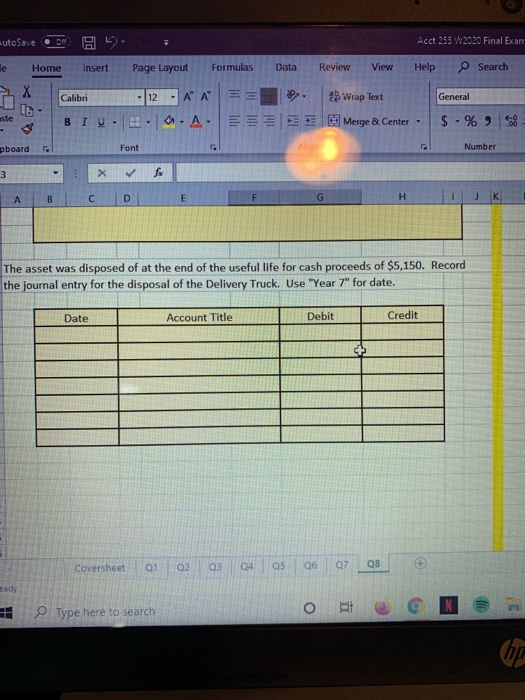

S E . General Calibri 12 AA B IU..A.A. Wrap Text Merge & Center - ste $ -% 9 ipboard Font Number for : * A B C Question 8 (9 marks) D A Calgary home developer purchased a delivery truck for $50,000 to deliver materials to jobsites. It will be used consistently over the next 5 years so straight line was selected. 5 At the end of the 5 year useful life they believe they can sell it for $8,000. REQUIRED: 9 Calculate the Truck's accumulated depreciation and the book value at the end of year 2. Accumulated Depreciation Ending Net Book Value Space for calculations here: 02 03 04 05 06 07 08 Ready Type here to search to search o N R . Calibri 12 AA BIU... a.A. Wrap Text Merge & Center General $ - % ipboard Font Numb 1 A B C D E FGESH 5 After using the Truck for 2 years, the developer determined they would get 7 years use 7 from the truck in total. At that point it would have an estimated residual value of $3,000. Calculate the amount of depreciation to be charged during each of the remaining years of 9 the Truck's revised useful life. Depreciation expense per year Space for calculations here: Coversheet 01 02 03 04 05 06 07 08 Type here to search Acct 255 w2020 Final Exan : Page Layout Formulas Data Review View Help Search utoSave A ) Home Insert X Calibri * BIU. == - 6 12 . A .A Wrap Text Merge & Center. General $% ste E 8 pboard Font Number The asset was disposed of at the end of the useful life for cash proceeds of $5,150. Record the journal entry for the disposal of the Delivery Truck. Use "Year 7" for date. Date Account Title Debit Credit Coversheet 01 02 03 04 05 06 07 08 Type here to search ON

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts