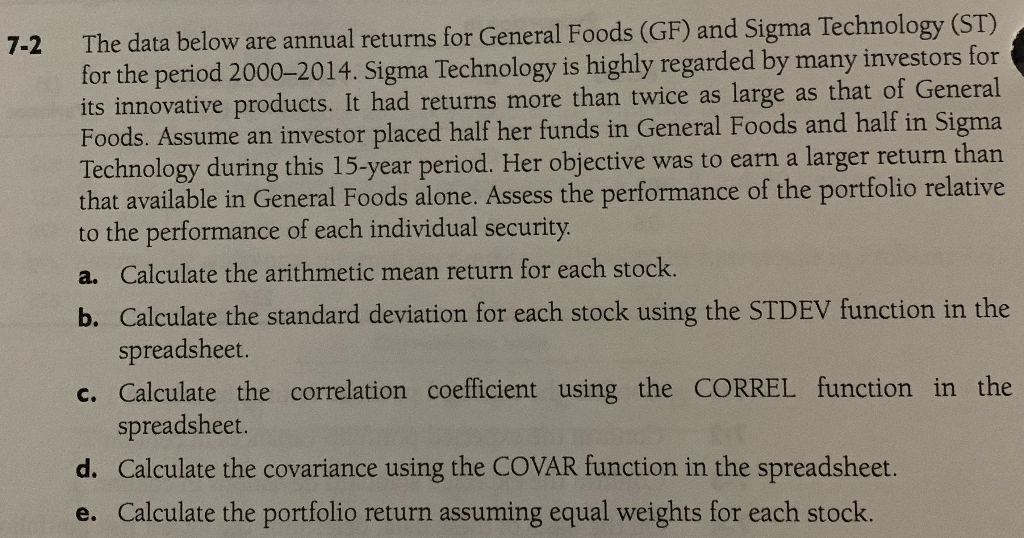

Question: s (GF) and Sigma Technology (ST) The data below are annual returns for General Food for the period 2000-2014. Sigma Technology is highly regarded by

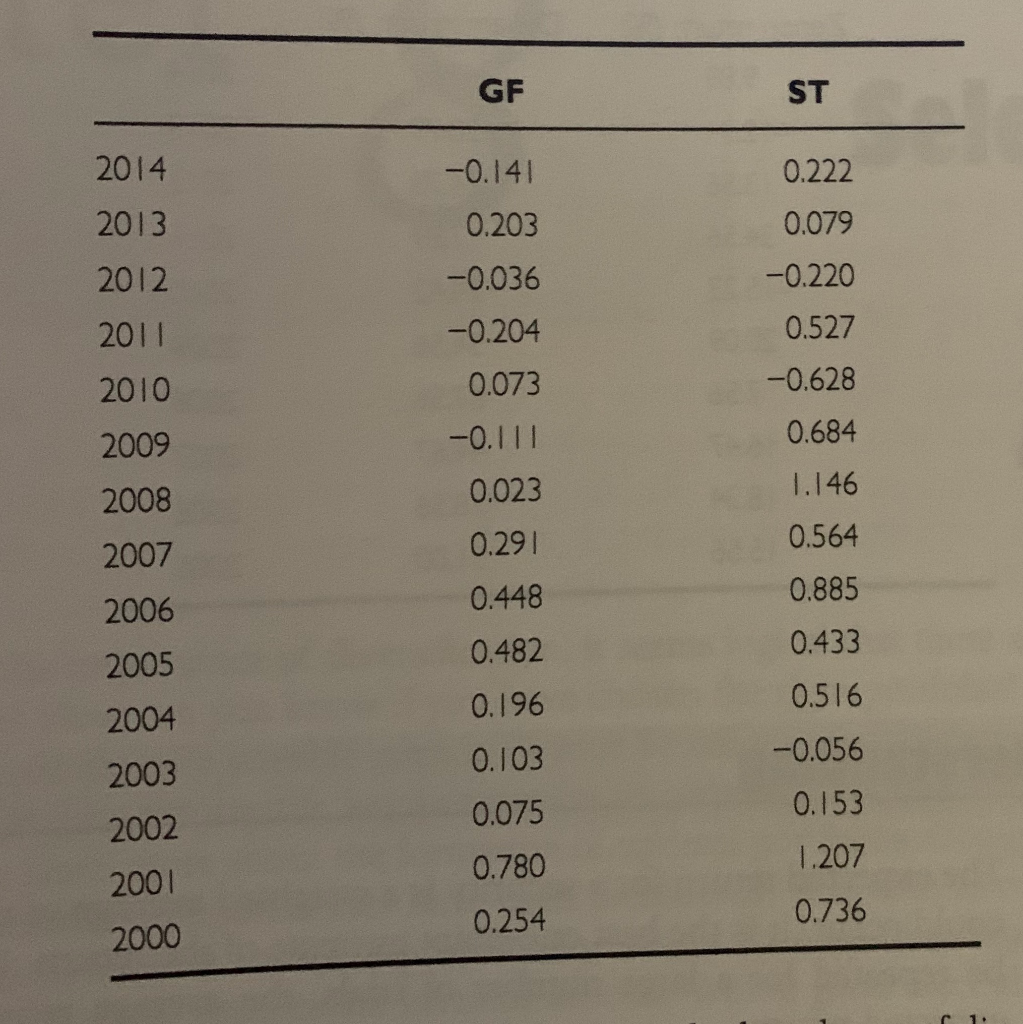

s (GF) and Sigma Technology (ST) The data below are annual returns for General Food for the period 2000-2014. Sigma Technology is highly regarded by many investors for its innovative products. It had returns more than twice as large as that of General Foods. Assume an investor placed half her funds in General Foods and half in Sigma Technology during this 15-year period. Her objective was to earn a larger return than that available in General Foods alone. Assess the performance of the portfolio relative to the performance of each individual security a. Calculate the arithmetic mean return for each stock. 7-2 b. Calculate the standard deviation for each stock using the STDEV function in the spreadsheet c. Calculate the correlation coefficient using the CORREL function in the spreadsheet Calculate the covariance using the COVAR function in the spreadsheet. Calculate the portfolio return assuming equal weights for each stock. d. e. 290784645 272228468315 2 O 2 5 6 6 0000001 366376 503 2 158450| F-41 3 3 4 3 1 2 9 8 8 9 3 5 8 311 3 1 8 2 6 3 504 403 890785 411 1 321 4321098765

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts