Question: S Homework Exercises (graded) Exercise 1 A Circle the statement(s) below that are true. AExternal risk messaging refers to communicating ERM information to external stakeholders

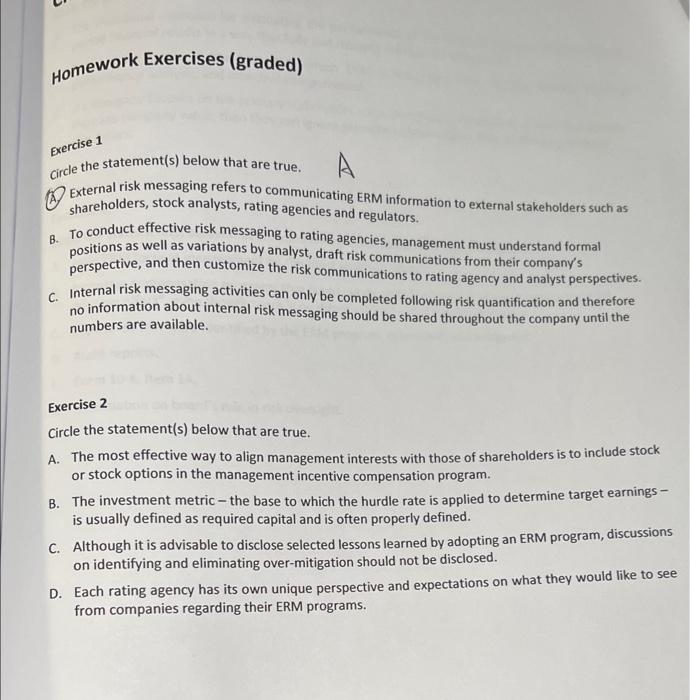

S Homework Exercises (graded) Exercise 1 A Circle the statement(s) below that are true. AExternal risk messaging refers to communicating ERM information to external stakeholders such as shareholders, stock analysts, rating agencies and regulators. B. To conduct effective risk messaging to rating agencies, management must understand formal positions as well as variations by analyst , draft risk communications from their company's perspective, and then customize the risk communications to rating agency and analyst perspectives. c Internal risk messaging activities can only be completed following risk quantification and therefore no information about internal risk messaging should be shared throughout the company until the numbers are available. Exercise 2 Circle the statement(s) below that are true. A. The most effective way to align management interests with those of shareholders is to include stock or stock options in the management incentive compensation program. B. The investment metric - the base to which the hurdle rate is applied to determine target earnings - is usually defined as required capital and is often properly defined. C. Although it is advisable to disclose selected lessons learned by adopting an ERM program, discussions on identifying and eliminating over-mitigation should not be disclosed. D. Each rating agency has its own unique perspective and expectations on what they would like to see from companies regarding their ERM programs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts