Question: s MBht: Practice Problem Chapter 04 Analysis of Financial statements (Practice) Problem 4.14 banatsheh yengeleh Activity Informaton Question 14of24 Check My Work eBook Problem Walk-Through

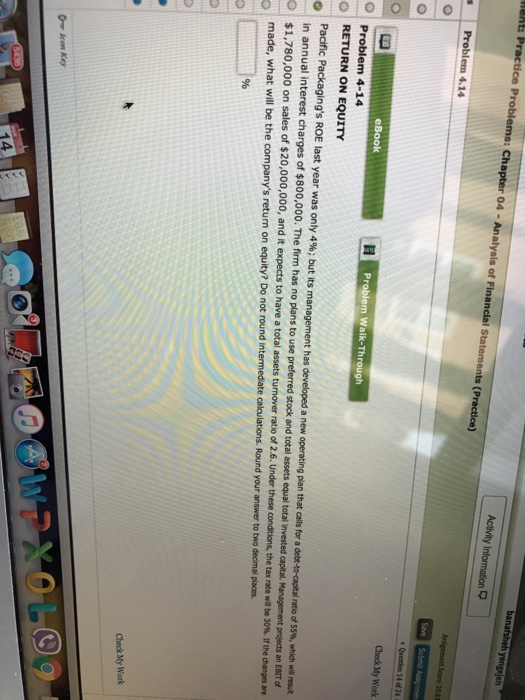

s MBht: Practice Problem Chapter 04 Analysis of Financial statements (Practice) Problem 4.14 banatsheh yengeleh Activity Informaton Question 14of24 Check My Work eBook Problem Walk-Through Problem 4-14 o RETURN ON EQUITY Pacific Packaging's ROE last year was only 4%; but its management has developed a new operating plan that calls for a debt-to-capital ratio of 55%, which wil resut in annual interest charges of $800,000. The firm has no plans to use preferred stock and total assets equal total invested capital. projects an EBIT of o $1,780,000 on sales of $20,000,000, and it expects to have a total assets Management made, what tumover ratio of 2.6. Under these conditions, the tax 30%. irthe changes will be the company's return on equity? Do not round intermediate ane caloulations. Round your answer to two decimalplaces. Check My Work Icon Key

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts