Question: s. Prepare a postclosing trial balance. CUMULATIVE REVIEW PROBLEM: CHAPTER 4 The purpose of this problem is to provide an opportunity to review both new

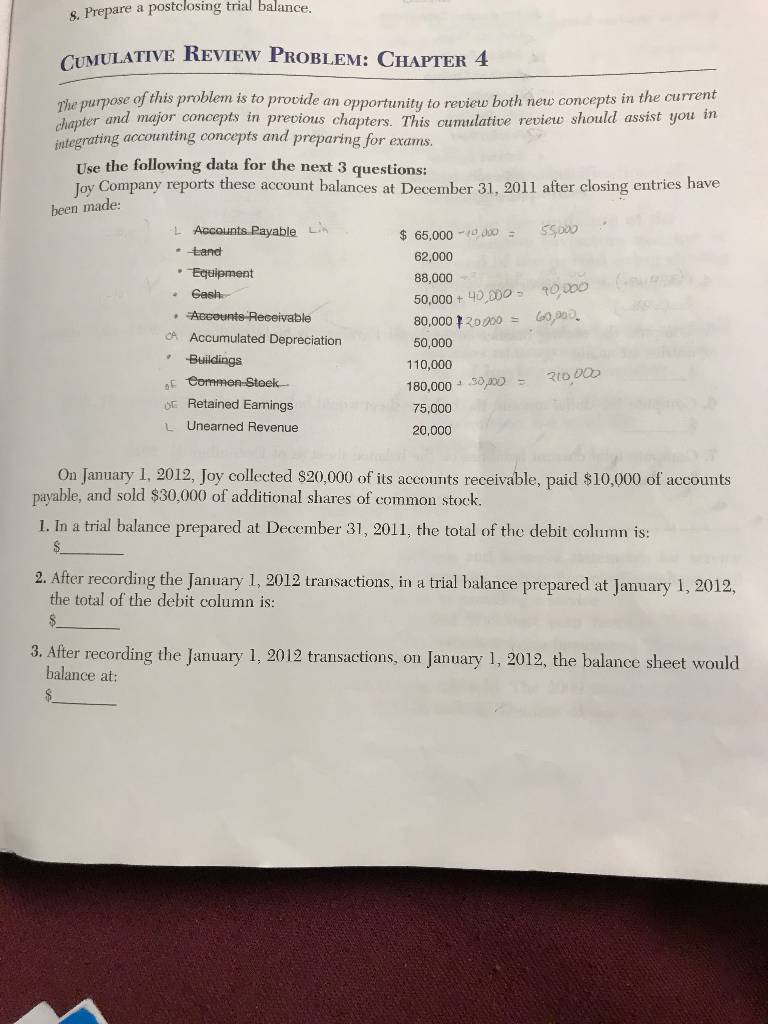

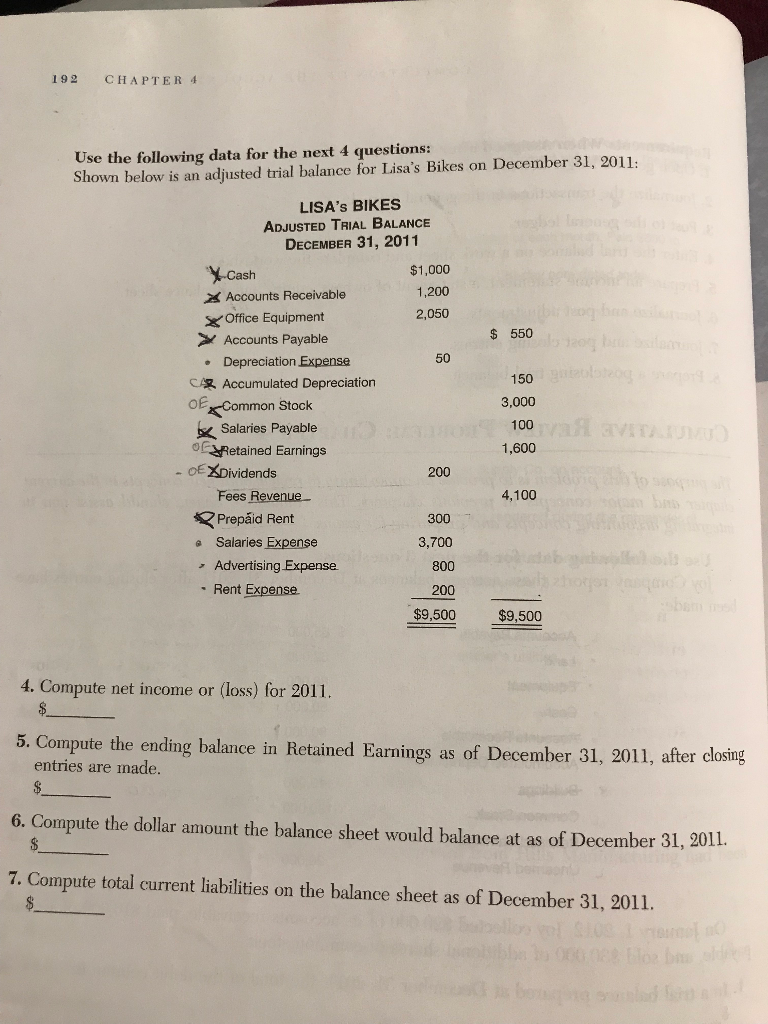

s. Prepare a postclosing trial balance. CUMULATIVE REVIEW PROBLEM: CHAPTER 4 The purpose of this problem is to provide an opportunity to review both new concepts in the current apter and major concepts in previous chapters. This cumulative review should assist you in integrating accounting concepts and preparing for exams. Use the following data for the next 3 questions: Joy Company reports these account balances at December 31, 2011 after closing entries have heen made: - Accounts Payable Lin tandt Equipment Gash Absounts Receivable CA Accumulated Depreciation Buildings E Comen-Steek- OC Retained Earnings L Unearned Revenue $ 65,000 - 10.000 55.000 62,000 88,000 50,000 + 40.000 - 10,000 80,000 20.000 = 60,000 50,000 110,000 180,000 + 30,000 - 20000 75,000 20,000 On January 1, 2012, Joy collected $20,000 of its accounts receivable, paid $10,000 of accounts payable, and sold $30,000 of additional shares of common stock. 1. In a trial balance prepared at December 31, 2011, the total of the debit column is: 2. After recording the January 1, 2012 transactions, in a trial balance prepared at January 1, 2012, the total of the debit column is: 3. After recording the January 1, 2012 transactions, on January 1, 2012, the balance sheet would balance at: 192 CHAPTER 4 Use the following data for the next 4 questions: Shown below is an adjusted trial balance for Lisa's Bikes on December 31, 2011: $ 550 50 g LISA's BIKES ADJUSTED TRIAL BALANCE DECEMBER 31, 2011 Cash $1,000 x Accounts Receivable 1,200 x Office Equipment 2,050 y Accounts Payable Depreciation Expense CA Accumulated Depreciation OE-Common Stock Salaries Payable o Retained Earnings - OE XDividends Fees Revenue Prepaid Rent 300 @ Salaries Expense > Advertising Expense 800 - Rent Expense 200 $9,500 150 3,000 100 1,600 200 4,100 3,700 $9,500 4. Compute net income or (loss) for 2011. 5. Compute the ending balance in Retained Earnings as of December 31, 2011, after closing entries are made. 6. Compute the dollar amount the balance sheet would balance at as of December 31, 2011. 7. Compute total current liabilities on the balance sheet as of December 31, 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts