Question: s Problem 4.13 (TIE and ROIC Ratios) eBook Problem Walk-Through Question 9 of 11 Check My Work (2 remaining) The W.C. Pruett Corp. has

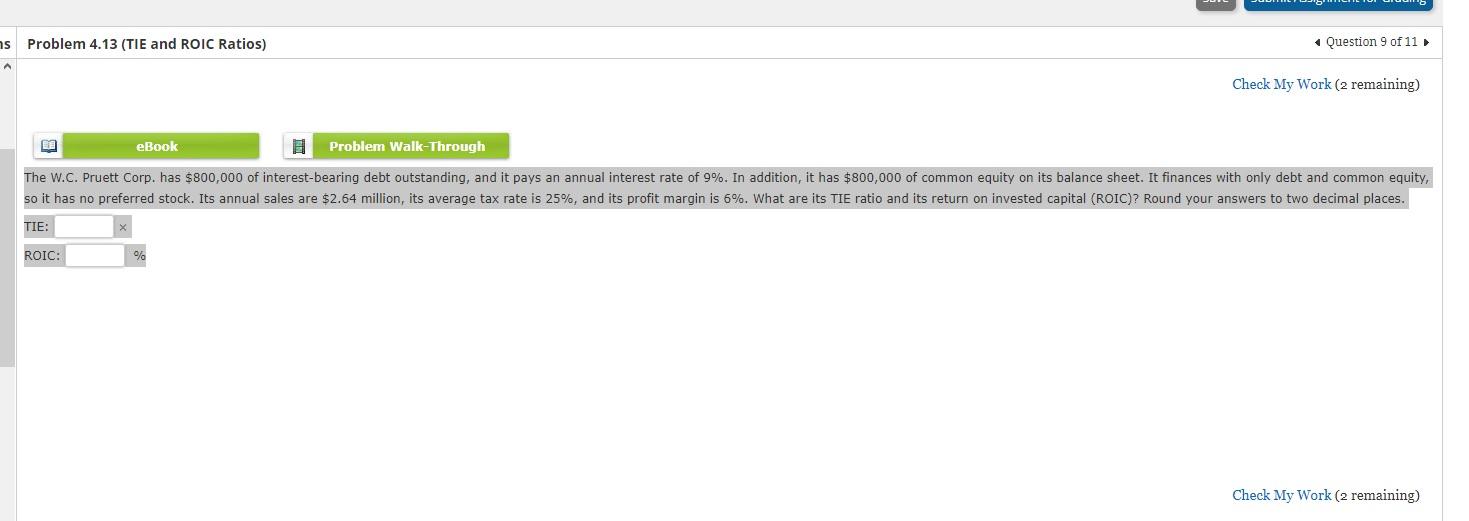

s Problem 4.13 (TIE and ROIC Ratios) eBook Problem Walk-Through Question 9 of 11 Check My Work (2 remaining) The W.C. Pruett Corp. has $800,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 9%. In addition, it has $800,000 of common equity on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its annual sales are $2.64 million, its average tax rate is 25%, and its profit margin is 6%. What are its TIE ratio and its return on invested capital (ROIC)? Round your answers to two decimal places. TIE: ROIC: % Check My Work (2 remaining)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts