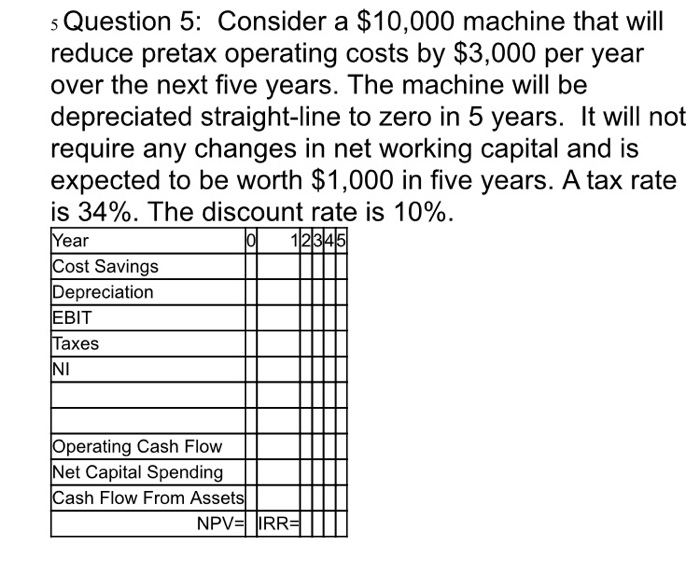

Question: s Question 5: Consider a $10,000 machine that will reduce pretax operating costs by $3,000 per year over the next five years. The machine will

s Question 5: Consider a $10,000 machine that will reduce pretax operating costs by $3,000 per year over the next five years. The machine will be depreciated straight-line to zero in 5 years. It will not require any changes in net working capital and is expected to be worth $1,000 in five years. A tax rate is 34%. The discount rate is 10%. Year 12345 Cost Savings Depreciation EBIT Taxes L NI Operating Cash Flow Net Capital Spending Cash Flow From Assets NPV= IRRIL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts