Question: S: stock price P: put value C: call value K: strike/exercise price e: Euler's constant r: risk-free interest rate T-t: expiration date Suppose S =

S: stock price

S: stock price

P: put value

C: call value

K: strike/exercise price

e: Euler's constant

r: risk-free interest rate

T-t: expiration date

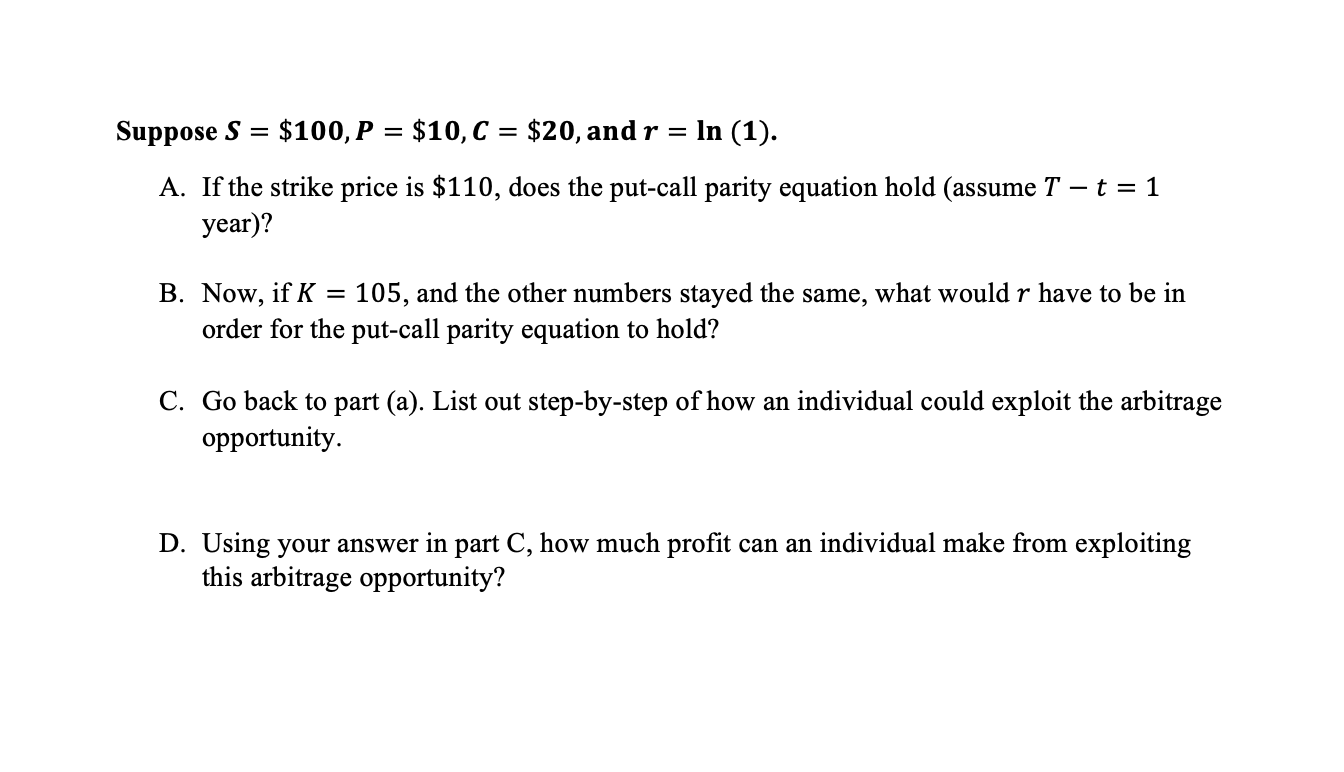

Suppose S = $100, P = $10,C = $20, and r = In (1). A. If the strike price is $110, does the put-call parity equation hold (assume T - t = 1 year)? B. Now, if K = 105, and the other numbers stayed the same, what would r have to be in order for the put-call parity equation to hold? C. Go back to part (a). List out step-by-step of how an individual could exploit the arbitrage opportunity. D. Using your answer in part C, how much profit can an individual make from exploiting this arbitrage opportunity? Suppose S = $100, P = $10,C = $20, and r = In (1). A. If the strike price is $110, does the put-call parity equation hold (assume T - t = 1 year)? B. Now, if K = 105, and the other numbers stayed the same, what would r have to be in order for the put-call parity equation to hold? C. Go back to part (a). List out step-by-step of how an individual could exploit the arbitrage opportunity. D. Using your answer in part C, how much profit can an individual make from exploiting this arbitrage opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts