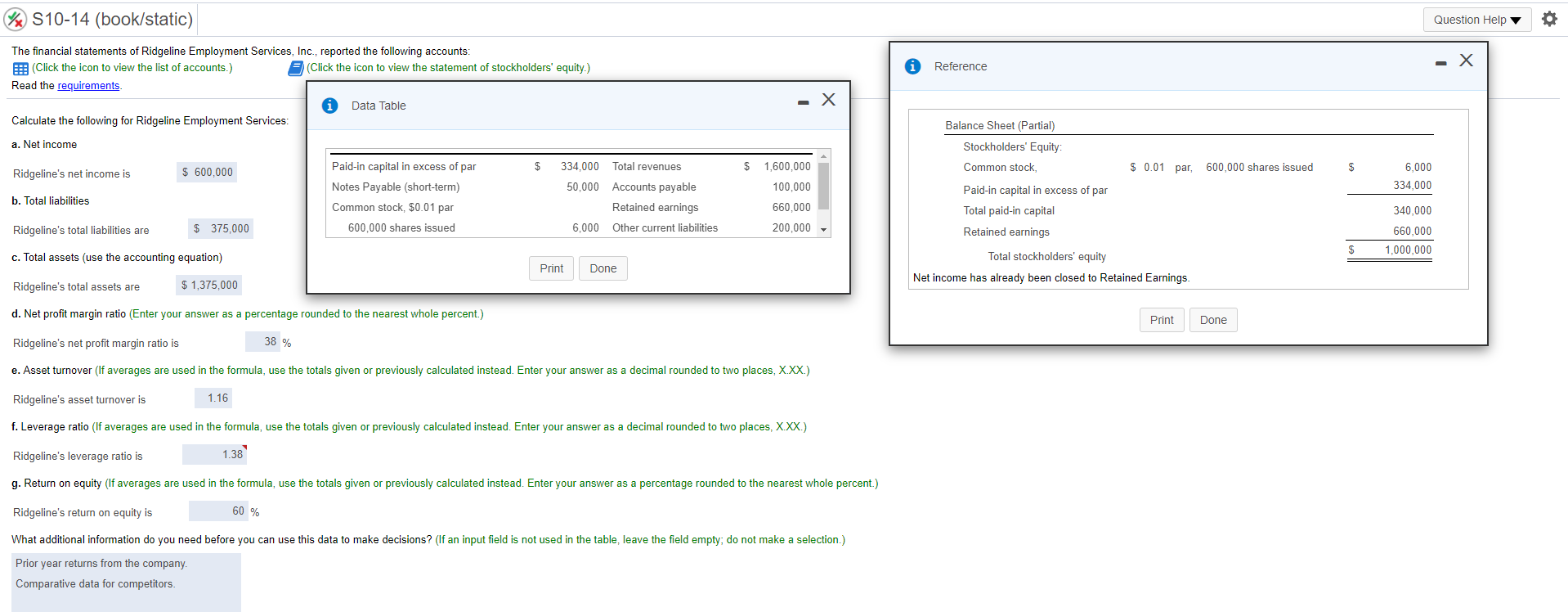

Question: S10-14 (book/static) Question Help - X Reference The financial statements of Ridgeline Employment Services, Inc., reported the following accounts: (Click the icon to view the

S10-14 (book/static) Question Help - X Reference The financial statements of Ridgeline Employment Services, Inc., reported the following accounts: (Click the icon to view the list of accounts.) (Click the icon to view the statement of stockholders' equity.) Read the requirements Data Table Calculate the following for Ridgeline Employment Services: Balance Sheet (Partial) Stockholders' Equity a. Net income $ $ 1,600,000 Common stock $ 600,000 $ 0.01 par, 600,000 shares issued Ridgeline's net income is 334,000 Total revenues 50,000 Accounts payable Retained earnings 6,000 334,000 100.000 Paid-in capital in excess of par Notes Payable (short-term) Common stock, $0.01 par 600,000 shares issued b. Total liabilities 660,000 Paid-in capital in excess of par Total paid-in capital Retained earnings 340,000 Ridgeline's total liabilities are $ 375,000 6,000 Other current liabilities 200,000 660,000 1.000.000 c. Total assets (use the accounting equation) Print Done Total stockholders' equity Net income has already been closed to retained Earnings Ridgeline's total assets are $ 1,375,000 d. Net profit margin ratio (Enter your answer as a percentage rounded to the nearest whole percent.) Print Done Ridgeline's net profit margin ratio is 38 % e. Asset turnover (If averages are used in the formula, use the totals given or previously calculated instead. Enter your answer as a decimal rounded to two places, X.XX.) Ridgeline's asset turnover is 1.16 f. Leverage ratio (If averages are used in the formula, use the totals given or previously calculated instead. Enter your answer as a decimal rounded to two places, X.XX.) Ridgeline's leverage ratio is 1.38 g. Return on equity (If averages are used in the formula, use the totals given or previously calculated instead. Enter your answer as a percentage rounded to the nearest whole percent.) Ridgeline's return on equity is 60 % What additional information do you need before you can use this data to make decisions? (If an input field is not used in the table, leave the field empty, do not make a selection.) Prior year returns from the company. Comparative data for competitors. S10-14 (book/static) Question Help - X Reference The financial statements of Ridgeline Employment Services, Inc., reported the following accounts: (Click the icon to view the list of accounts.) (Click the icon to view the statement of stockholders' equity.) Read the requirements Data Table Calculate the following for Ridgeline Employment Services: Balance Sheet (Partial) Stockholders' Equity a. Net income $ $ 1,600,000 Common stock $ 600,000 $ 0.01 par, 600,000 shares issued Ridgeline's net income is 334,000 Total revenues 50,000 Accounts payable Retained earnings 6,000 334,000 100.000 Paid-in capital in excess of par Notes Payable (short-term) Common stock, $0.01 par 600,000 shares issued b. Total liabilities 660,000 Paid-in capital in excess of par Total paid-in capital Retained earnings 340,000 Ridgeline's total liabilities are $ 375,000 6,000 Other current liabilities 200,000 660,000 1.000.000 c. Total assets (use the accounting equation) Print Done Total stockholders' equity Net income has already been closed to retained Earnings Ridgeline's total assets are $ 1,375,000 d. Net profit margin ratio (Enter your answer as a percentage rounded to the nearest whole percent.) Print Done Ridgeline's net profit margin ratio is 38 % e. Asset turnover (If averages are used in the formula, use the totals given or previously calculated instead. Enter your answer as a decimal rounded to two places, X.XX.) Ridgeline's asset turnover is 1.16 f. Leverage ratio (If averages are used in the formula, use the totals given or previously calculated instead. Enter your answer as a decimal rounded to two places, X.XX.) Ridgeline's leverage ratio is 1.38 g. Return on equity (If averages are used in the formula, use the totals given or previously calculated instead. Enter your answer as a percentage rounded to the nearest whole percent.) Ridgeline's return on equity is 60 % What additional information do you need before you can use this data to make decisions? (If an input field is not used in the table, leave the field empty, do not make a selection.) Prior year returns from the company. Comparative data for competitors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts