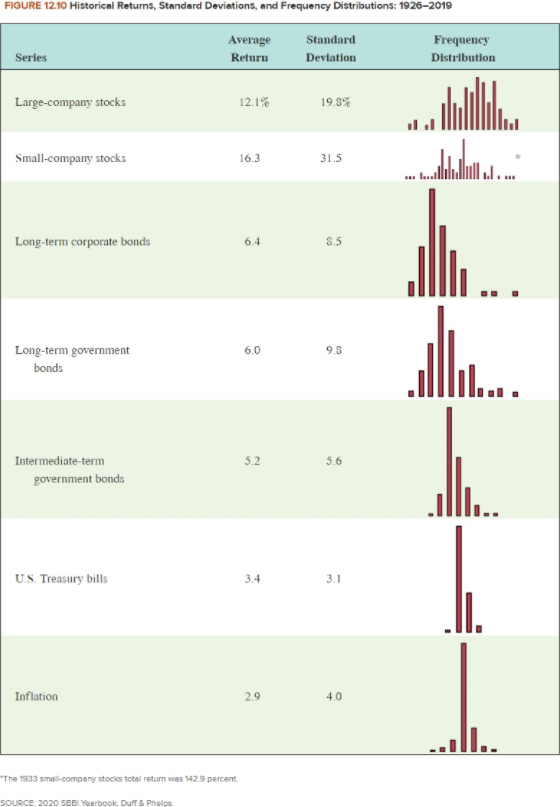

Question: S12-24 Using Probability Distributions (LO3] Suppose the returns on long-term corporate bonds and T-bills are normally distributed. Refer to Figure 12.10. Use the NORMDIST function

![S12-24 Using Probability Distributions (LO3] Suppose the returns on long-term corporate](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ff791b79523_71466ff791af0353.jpg)

S12-24 Using Probability Distributions (LO3] Suppose the returns on long-term corporate bonds and T-bills are normally distributed. Refer to Figure 12.10. Use the NORMDIST function in Excel to answer the following questions. a. What is the probability that in any given year, the return on long-term corporate bonds will be greater than 10 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on T-bills will be greater than 10 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) C-1. In 1980, the return on long-term government bonds was -3.95 percent. How likely is it that such a low return will recur at some point in the future? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. T-bills had a return of 11.24 percent in this same year. How likely is it that such a high return on T-bills will recur at some point in the future? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Greater than 10 percent a. Less than 0 percent b. Greater than 10 percent b. Less than 0 percent C-1. Less than 3.95 percent c-2. Greater than 11.24 percent 33.41% 22.66% 1.66% 13.64% % % FIGURE 12.10 Historical Returns, Standard Deviations, and Frequency Distributions: 1926-2019 Average Standard Frequency Series Return Deviation Distribution Large-company stocks 12.1% 19.5% had. Small-company stocks 16.3 31.5 .. Long-term corporate bonds 6.4 8.5 6.0 9.5 Long-term government bonds ul . .... 5.2 5.6 Intermediate-term government bonds JL U.S. Treasury bills 3.4 3.1 Inflation 29 4.0 ll.. "The 1933 small-company stocks total return was 1429 percent SOURCE 2020 SBBI Yearbook Duff & Phelps S12-24 Using Probability Distributions (LO3] Suppose the returns on long-term corporate bonds and T-bills are normally distributed. Refer to Figure 12.10. Use the NORMDIST function in Excel to answer the following questions. a. What is the probability that in any given year, the return on long-term corporate bonds will be greater than 10 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on T-bills will be greater than 10 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) C-1. In 1980, the return on long-term government bonds was -3.95 percent. How likely is it that such a low return will recur at some point in the future? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. T-bills had a return of 11.24 percent in this same year. How likely is it that such a high return on T-bills will recur at some point in the future? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Greater than 10 percent a. Less than 0 percent b. Greater than 10 percent b. Less than 0 percent C-1. Less than 3.95 percent c-2. Greater than 11.24 percent 33.41% 22.66% 1.66% 13.64% % % FIGURE 12.10 Historical Returns, Standard Deviations, and Frequency Distributions: 1926-2019 Average Standard Frequency Series Return Deviation Distribution Large-company stocks 12.1% 19.5% had. Small-company stocks 16.3 31.5 .. Long-term corporate bonds 6.4 8.5 6.0 9.5 Long-term government bonds ul . .... 5.2 5.6 Intermediate-term government bonds JL U.S. Treasury bills 3.4 3.1 Inflation 29 4.0 ll.. "The 1933 small-company stocks total return was 1429 percent SOURCE 2020 SBBI Yearbook Duff & Phelps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts