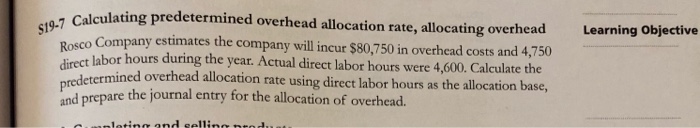

Question: S19-7 S19-10 ulating predetermined overhead allocation rate, allocating overhead o Company estimates the company will incur $80,750 in overhead costs and 4,750 t labor hours

ulating predetermined overhead allocation rate, allocating overhead o Company estimates the company will incur $80,750 in overhead costs and 4,750 t labor hours during the year. Actual direct labor hours were 4,600. Calculate the etermined overhead allocation rate using direct labor hours as the allocation base $19-7 Calc Learning Objective Rosco direc and prepare the journal entry for the allocation of overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts