Question: s-2018:4 Fal, BUAD2040 901 Chapter 3 Review Assignment w Assignment 6 Help Save&Exit Submit Check my work Clark Bell started a personal financial planning business

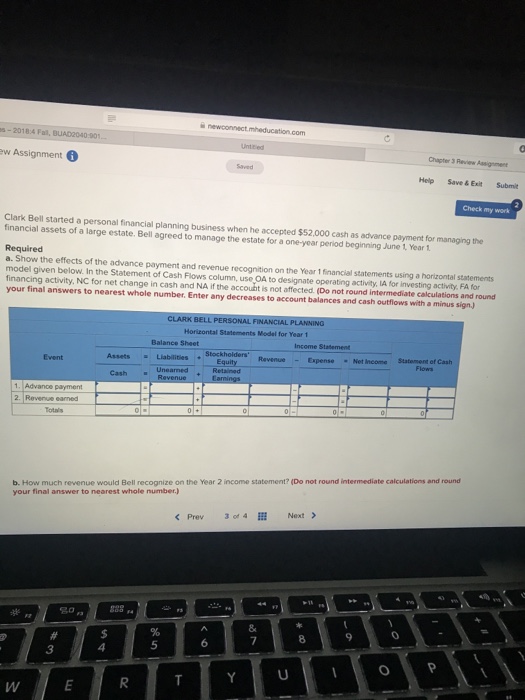

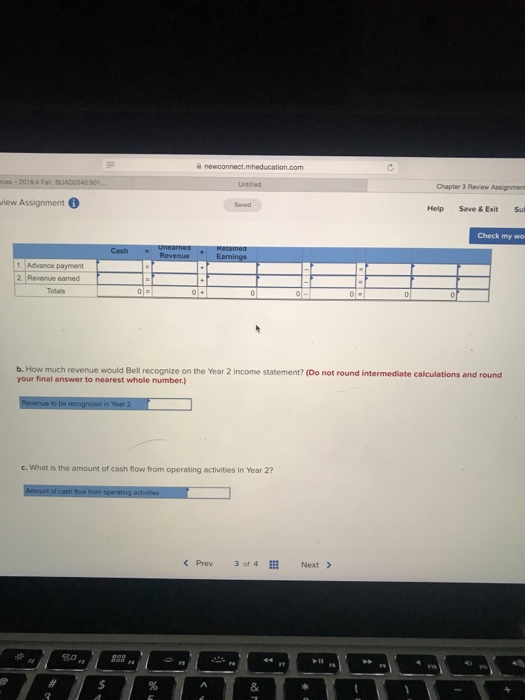

s-2018:4 Fal, BUAD2040 901 Chapter 3 Review Assignment w Assignment 6 Help Save&Exit Submit Check my work Clark Bell started a personal financial planning business when he accepted $52,000 cash as advance payment for managing the financial assets of a large estate. Bell agreed to manage the estate for a one-year period beginning June 1 Year 1 Required a. Show the effects of the advance payment and revenue recognition on the Year 1 financial statements using a horizontal statements model given below. In the Statement of Cash Flows column, use OA to designate operating activity, IA for investing activity FA for financing activity, NC for net change in cash and NA if the account is not affected. (Do not round intermediate calculations and round your final answers to nearest whole number. Enter any decreases to account balances and cash outfiows with a minus sign) Horizontal Statements Model for Year 1 Balance Sheet Stockholders' RavenueE Assets Liablities Expense Net Income Statement of Cash CashUnearedRetained Advance payment 2. Revenue earned b. How much revenue would Bell recognize on the Year 2 income statement? (Do not round intermediate calculations and round your final answer to nearest whole number.) Prevf 4 Next 20 a 888 a 8 9 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts