Question: S7-12. (Learning Objective 3: Compute depreciation using double-declining-balance method with residual value) Using the double-declining-balance method of depreciation, calculate the following amounts for the van

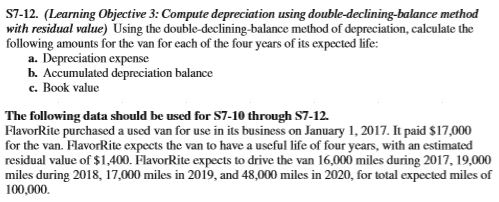

S7-12. (Learning Objective 3: Compute depreciation using double-declining-balance method with residual value) Using the double-declining-balance method of depreciation, calculate the following amounts for the van for each of the four years of its expected life: a. Depreciation expense b. Accumulated depreciation balance c. Book value The following data should be used for S7-10 through S7-12. FlavorRite purchased a used van for use in its business on January 1, 2017. It paid $17,000 for the van. FlavorRite expects the van to have a useful life of four years, with an estimated residual value of $1,400. FlavorRite expects to drive the van 16,000 miles during 2017, 19,000 miles during 2018, 17,000 miles in 2019, and 48,000 miles in 2020, for total expected miles of 100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts