Question: S8-8 Identifying timing differences related to a bank reconciliation Learning Objective 6 For each timing difference listed, identify whether the difference would be reported on

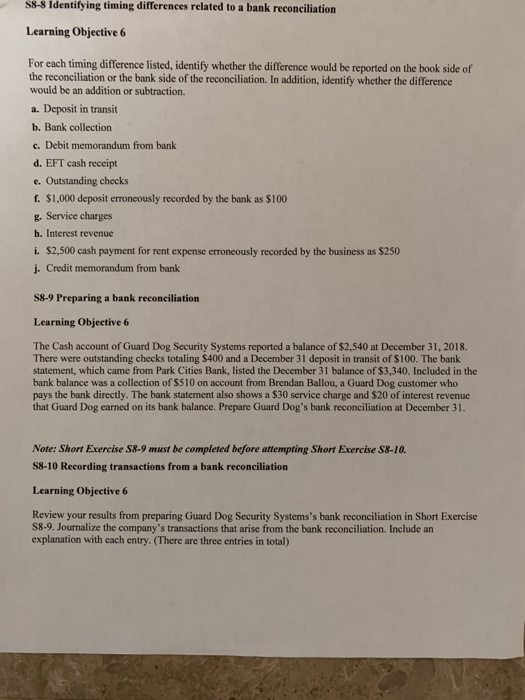

S8-8 Identifying timing differences related to a bank reconciliation Learning Objective 6 For each timing difference listed, identify whether the difference would be reported on the book side of the reconciliation or the bank side of the reconciliation. In addition, identify whether the difference would be an addition or subtraction. a. Deposit in transit b. Bank collection e. Debit memorandum from bank d. EFT cash receipt e. Outstanding checks f. $1,000 deposit erroneously recorded by the bank as $100 g. Service charges h. Interest revenue I. $2,500 cash payment for rent expense erroneously recorded by the business as $250 j. Credit memorandum from bank S8-9 Preparing a bank reconciliation Learning Objective 6 The Cash account of Guard Dog Security Systems reported a balance of $2,540 at December 31, 2018. There were outstanding checks totaling $400 and a December 31 deposit in transit of $100. The bank statement, which came from Park Cities Bank, listed the December 31 balance of $3,340. Included in the bank balance was a collection of $510 on account from Brendan Ballou, a Guard Dog customer who pays the bank directly. The bank statement also shows a $30 service charge and $20 of interest revenue that Guard Dog earned on its bank balance. Prepare Guard Dog's bank reconciliation at December 31. Note: Short Exercise 58-9 must be completed before attempting Short Exercise 58-10. S8-10 Recording transactions from a bank reconciliation Learning Objective 6 Review your results from preparing Guard Dog Security Systems's bank reconciliation in Short Exercise 58-9. Journalize the company's transactions that arise from the bank reconciliation. Include an explanation with each entry. (There are three entries in total)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts