Question: S9-4 Computing second-year deprecia- tion and accumulated depreciation Learning Objective 2 On January 1, 2018, Advanced Airline purchased a used airplane at a cost of

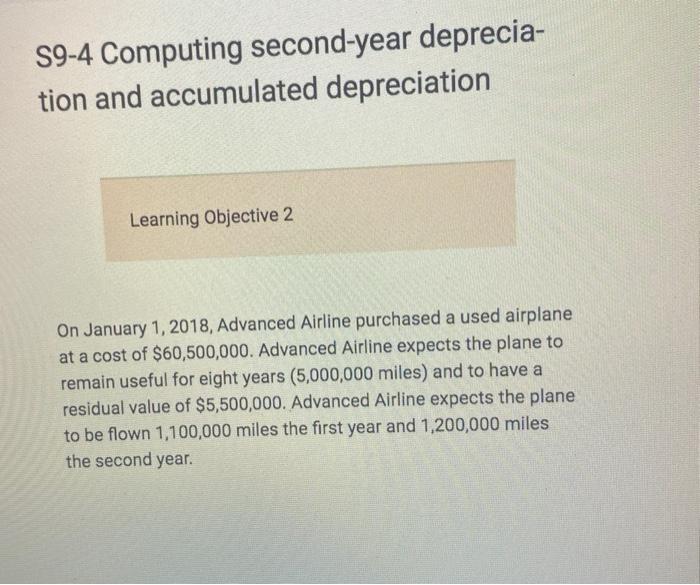

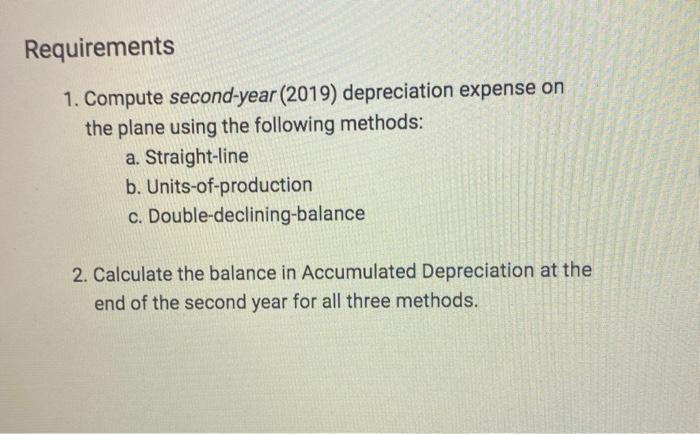

S9-4 Computing second-year deprecia- tion and accumulated depreciation Learning Objective 2 On January 1, 2018, Advanced Airline purchased a used airplane at a cost of $60,500,000. Advanced Airline expects the plane to remain useful for eight years (5,000,000 miles) and to have a residual value of $5,500,000. Advanced Airline expects the plane to be flown 1,100,000 miles the first year and 1,200,000 miles the second year. Requirements 1. Compute second-year (2019) depreciation expense on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining-balance 2. Calculate the balance in Accumulated Depreciation at the end of the second year for all three methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts