Question: S9-4. (Learning Objective 1: Determine bonds payable amounts with a discount; amortize bonds using the straight-line method) Starlight Drive-Ins Lid. borrowed money by issuing $5,000,000

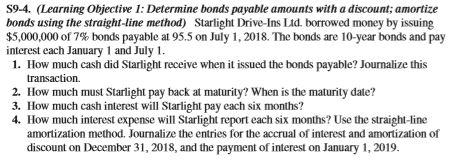

S9-4. (Learning Objective 1: Determine bonds payable amounts with a discount; amortize bonds using the straight-line method) Starlight Drive-Ins Lid. borrowed money by issuing $5,000,000 of 7% bonds payable at 95.5 on July 1 , 2018. The bonds are 10-year bonds and pay interest each January 1 and July1 1. How much cash did Starlight receive when it issued the bonds payable? Journalize this transaction. 2. How much must Starlight pay back at maturity? When is the maturity date? 3. How much cash interest will Starlight pay each six months? 4. How much interest expense will Starlight report each six months? Use the straight-line amortization method. Journalize the entries for the accrual of interest and amortization of discount on December 3, 2018, and the payment of interest on January 1, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts