Question: SABIC, Inc. develops and markets computer software. During 2017, one of SABIC's engineers began developing a new and very innovative software product. On April 1,

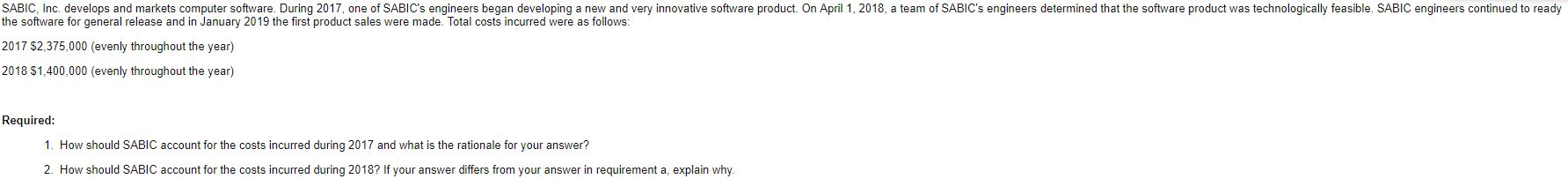

SABIC, Inc. develops and markets computer software. During 2017, one of SABIC's engineers began developing a new and very innovative software product. On April 1, 2018, a team of SABIC's engineers determined that the software product was technologically feasible. SABIC engineers continued to ready the software for general release and in January 2019 the first product sales were made. Total costs incurred were as follows: 2017 $2,375,000 (evenly throughout the year) 2018 $1,400,000 (evenly throughout the year) Required: 1. How should SABIC account for the costs incurred during 2017 and what is the rationale for your answer? 2. How should SABIC account for the costs incurred during 2018? If your answer differs from your answer in requirement a, explain why. SABIC, Inc. develops and markets computer software. During 2017, one of SABIC's engineers began developing a new and very innovative software product. On April 1, 2018, a team of SABIC's engineers determined that the software product was technologically feasible. SABIC engineers continued to ready the software for general release and in January 2019 the first product sales were made. Total costs incurred were as follows: 2017 $2,375,000 (evenly throughout the year) 2018 $1,400,000 (evenly throughout the year) Required: 1. How should SABIC account for the costs incurred during 2017 and what is the rationale for your answer? 2. How should SABIC account for the costs incurred during 2018? If your answer differs from your answer in requirement a, explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts