Question: Sable Construction entered into a contract beginning on January 1, 2020 to construct an office building for a customer. The sale price of the

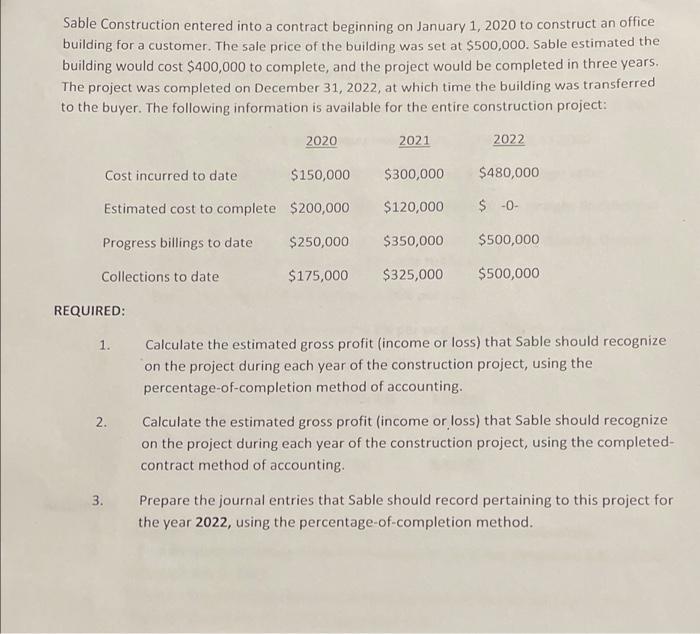

Sable Construction entered into a contract beginning on January 1, 2020 to construct an office building for a customer. The sale price of the building was set at $500,000. Sable estimated the building would cost $400,000 to complete, and the project would be completed in three years. The project was completed on December 31, 2022, at which time the building was transferred to the buyer. The following information is available for the entire construction project: 2020 2021 2022 Cost incurred to date $150,000 $300,000 $480,000 Estimated cost to complete $200,000 $120,000 $ -0- Progress billings to date $250,000 $350,000 $500,000 Collections to date $175,000 $325,000 $500,000 REQUIRED: 1. 2. Calculate the estimated gross profit (income or loss) that Sable should recognize on the project during each year of the construction project, using the percentage-of-completion method of accounting. Calculate the estimated gross profit (income or loss) that Sable should recognize on the project during each year of the construction project, using the completed- contract method of accounting. 3. Prepare the journal entries that Sable should record pertaining to this project for the year 2022, using the percentage-of-completion method.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts