Question: Sacamano Corp. is considering a new project that will require some investments in Net Working Capital. Suppose the forecast is as follows: at t=0, Inventory

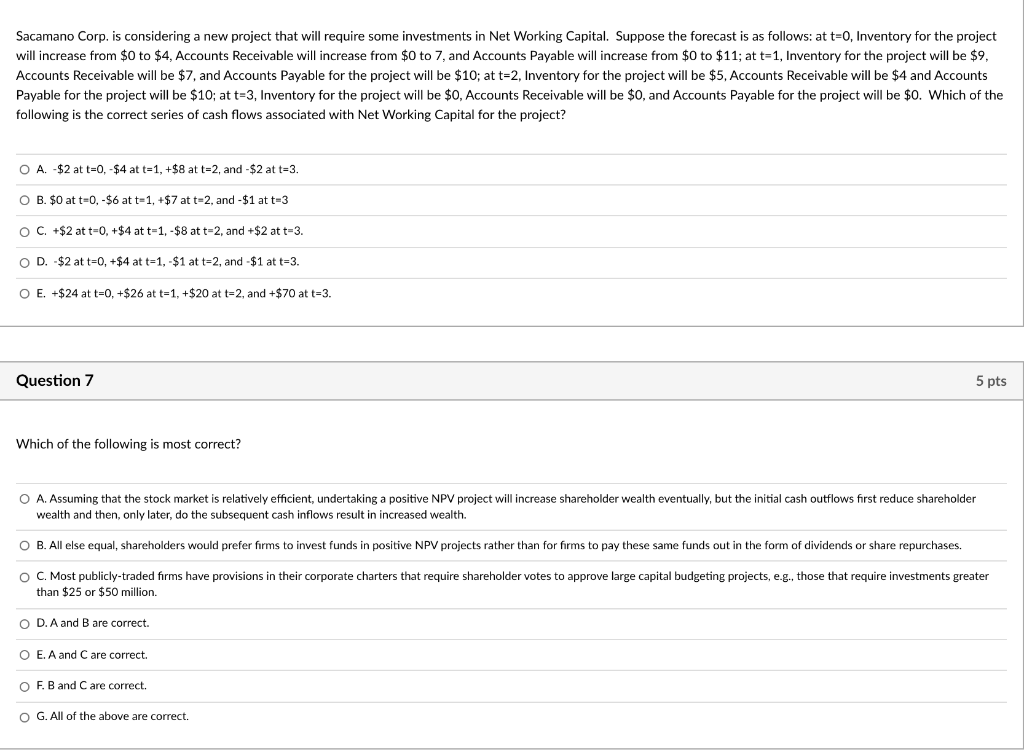

Sacamano Corp. is considering a new project that will require some investments in Net Working Capital. Suppose the forecast is as follows: at t=0, Inventory for the project will increase from $0 to $4, Accounts Receivable will increase from $0 to 7, and Accounts Payable will increase from $0 to $11; at t=1, Inventory for the project will be $9. Accounts Receivable will be $7, and Accounts Payable for the project will be $10; at t=2, Inventory for the project will be $5, Accounts Receivable will be $4 and Accounts Payable for the project will be $10; at t=3, Inventory for the project will be $0, Accounts Receivable will be $0, and Accounts Payable for the project will be $0. Which of the following is the correct series of cash flows associated with Net Working Capital for the project? O A. -$2 at t=0,-$4 at t=1, +$8 at t=2, and -$2 at t=3. O B. $0 at t=0,-$6 at t=1, +$7 at t=2, and - $1 at t=3 O C. +$2 at t=0, +$4 at t=1,-$8 at t=2, and +$2 at t=3. O D. $2 at t=0, +$4 at t=1, $1 at t=2, and $1 at t=3. O E. +$24 at t=0, +$26 at t=1, +$20 at t=2, and +$70 at t=3. Question 7 5 pts Which of the following is most correct? O A. Assuming that the stock market is relatively efficient, undertaking a positive NPV project will increase shareholder wealth eventually, but the initial cash outflows first reduce shareholder wealth and then, only later, do the subsequent cash inflows result in increased wealth. O B. All else equal, shareholders would prefer firms to invest funds in positive NPV projects rather than for firms to pay these same funds out in the form of dividends or share repurchases. O C. Most publicly-traded firms have provisions in their corporate charters that require shareholder votes to approve large capital budgeting projects, e.g., those that require investments greater than $25 or $50 million. O D. A and B are correct. O E. A and Care correct. OF. B and C are correct. G. All of the above are correct. Sacamano Corp. is considering a new project that will require some investments in Net Working Capital. Suppose the forecast is as follows: at t=0, Inventory for the project will increase from $0 to $4, Accounts Receivable will increase from $0 to 7, and Accounts Payable will increase from $0 to $11; at t=1, Inventory for the project will be $9. Accounts Receivable will be $7, and Accounts Payable for the project will be $10; at t=2, Inventory for the project will be $5, Accounts Receivable will be $4 and Accounts Payable for the project will be $10; at t=3, Inventory for the project will be $0, Accounts Receivable will be $0, and Accounts Payable for the project will be $0. Which of the following is the correct series of cash flows associated with Net Working Capital for the project? O A. -$2 at t=0,-$4 at t=1, +$8 at t=2, and -$2 at t=3. O B. $0 at t=0,-$6 at t=1, +$7 at t=2, and - $1 at t=3 O C. +$2 at t=0, +$4 at t=1,-$8 at t=2, and +$2 at t=3. O D. $2 at t=0, +$4 at t=1, $1 at t=2, and $1 at t=3. O E. +$24 at t=0, +$26 at t=1, +$20 at t=2, and +$70 at t=3. Question 7 5 pts Which of the following is most correct? O A. Assuming that the stock market is relatively efficient, undertaking a positive NPV project will increase shareholder wealth eventually, but the initial cash outflows first reduce shareholder wealth and then, only later, do the subsequent cash inflows result in increased wealth. O B. All else equal, shareholders would prefer firms to invest funds in positive NPV projects rather than for firms to pay these same funds out in the form of dividends or share repurchases. O C. Most publicly-traded firms have provisions in their corporate charters that require shareholder votes to approve large capital budgeting projects, e.g., those that require investments greater than $25 or $50 million. O D. A and B are correct. O E. A and Care correct. OF. B and C are correct. G. All of the above are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts