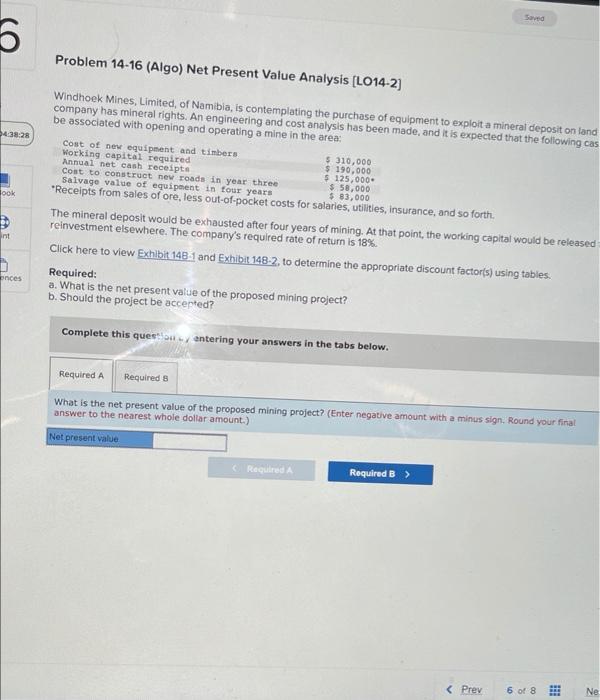

Question: Sad 5 Problem 14-16 (Algo) Net Present Value Analysis (L014-2) Ook Windhoek Mines, Limited, of Namibia, is contemplating the purchase of equipment to exploita mineral

Sad 5 Problem 14-16 (Algo) Net Present Value Analysis (L014-2) Ook Windhoek Mines, Limited, of Namibia, is contemplating the purchase of equipment to exploita mineral deposit on land company has mineral rights. An engineering and cost analysis has been made, and it is expected that the following cas be associated with opening and operating a mine in the area: Cost of new equipment and timbers $ 310,000 Working capital required $ 190,000 Annual net cash receipts $ 125,000 Cost to construct new roads in year three $ 50,000 Salvage value of equipment in four years $ 83,000 *Receipts from sales of ore, less out-of-pocket costs for salaries, utilities, insurance, and so forth. The mineral deposit would be exhausted after four years of mining, that point, the working capital would be released reinvestment elsewhere. The company's required rate of return is 18% Click here to view Exhibit 148.1 and Exhibit 14B-2, to determine the appropriate discount factoris) using tables. Required: a. What is the net present value of the proposed mining project? b. Should the project be accepted? nt onces Complete this question entering your answers in the tabs below. Required A Required s What is the net present value of the proposed mining project? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) Net present value Required Required B >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts