Question: Safari File Edit View Histony Window Help Return to Blackboard Parrino, Essentials of Corporate Finance, le Help I Problem 10.9 .10 Zippy Corporation just purchased

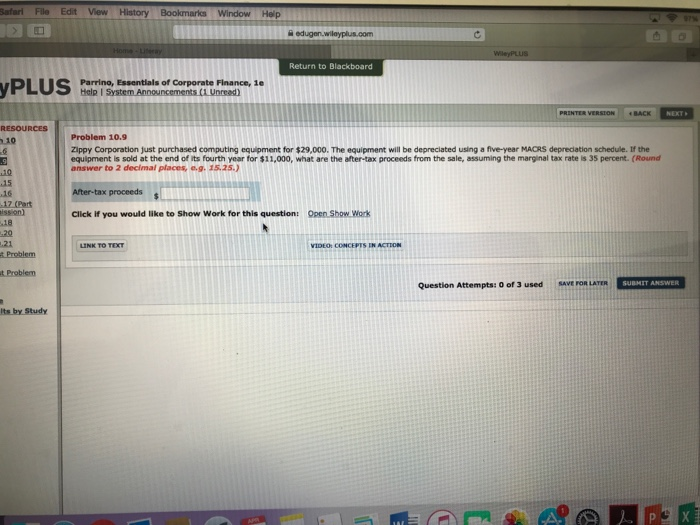

Safari File Edit View Histony Window Help Return to Blackboard Parrino, Essentials of Corporate Finance, le Help I Problem 10.9 .10 Zippy Corporation just purchased computing equipment for $29,000. The equipment will be depreciated using a five-year MAORS deprecation schedule. If the equipment is sold at the end of its fourth year for $11,000, what are the after-tax proceeds from the sale, assuming the marginal tax rate is 35 percent. (Round answer to 2 decimal places,.g.15.25.) 15 After-tax proceeds issen) 18 20 .21 Click if you would like to Show Work for this question: Open Sbow Work LINK TO TEXT t Problem Question Attempts: 0 of 3 used SAVE FOR LAYER SUBMIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts