Question: Safari File Edit View History Bookmarks Develop Window Help @ $ 7 94% Fri 6:14 PM Q E . . . O utexas.instructure.com C O

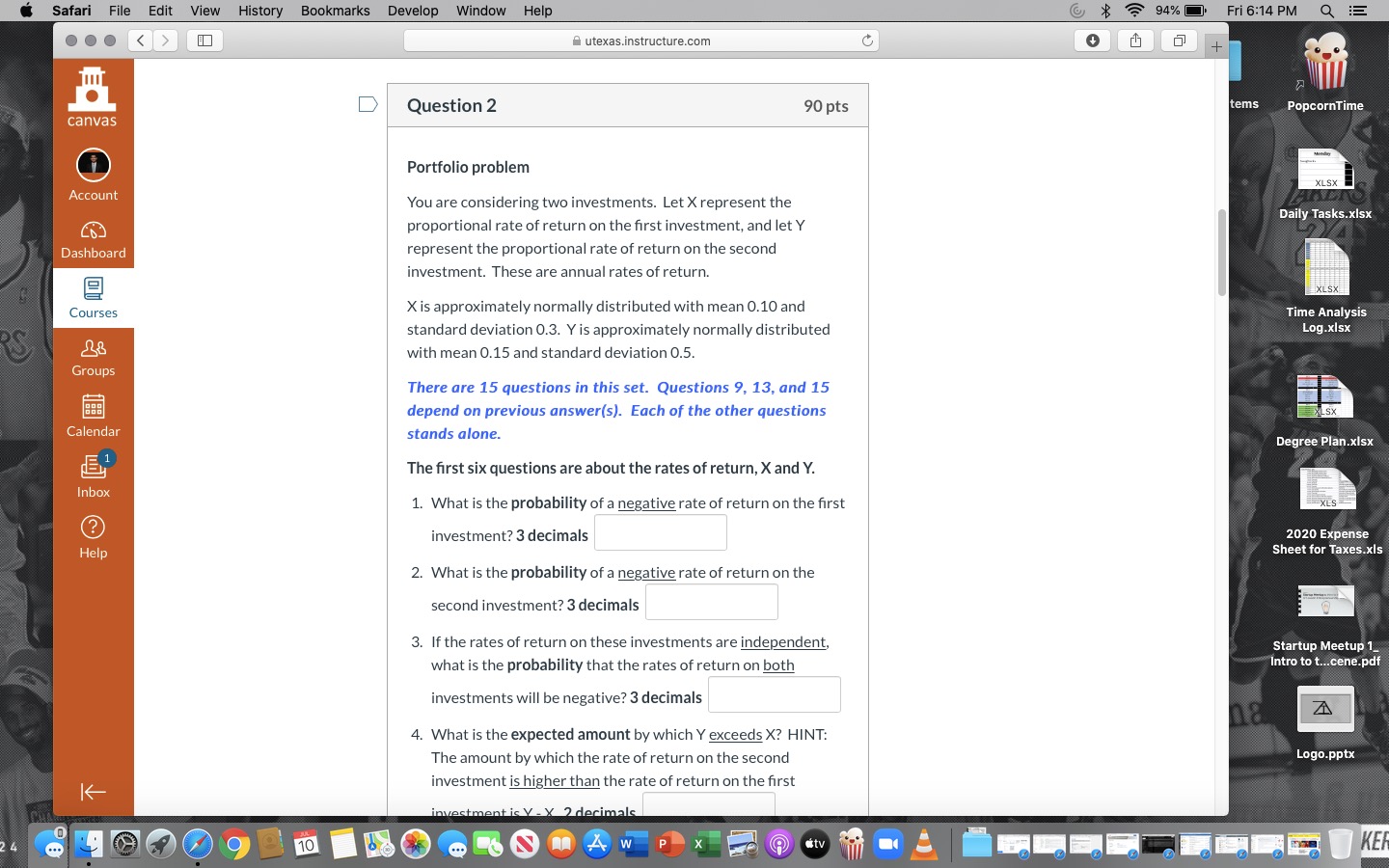

Safari File Edit View History Bookmarks Develop Window Help @ $ 7 94% Fri 6:14 PM Q E . . . O utexas.instructure.com C O + canvas D Question 2 90 pts tems PopcornTime Portfolio problem XLSX Account You are considering two investments. Let X represent the proportional rate of return on the first investment, and let Y Daily Tasks.xisx Dashboard represent the proportional rate of return on the second investment. These are annual rates of return. XLSX Courses X is approximately normally distributed with mean 0.10 and Time Analysis RS standard deviation 0.3. Y is approximately normally distributed Log.xIsx with mean 0.15 and standard deviation 0.5. Groups There are 15 questions in this set. Questions 9, 13, and 15 88g depend on previous answer(s). Each of the other questions XLSX Calendar stands alone. Degree Plan.xIsx The first six questions are about the rates of return, X and Y. Inbox 1. What is the probability of a negative rate of return on the first XLS ? investment? 3 decimals 2020 Expense Help Sheet for Taxes.xls 2. What is the probability of a negative rate of return on the second investment? 3 decimals 3. If the rates of return on these investments are independent, Startup Meetup 1_ what is the probability that the rates of return on both Intro to t...cene.pdf investments will be negative? 3 decimals A 4. What is the expected amount by which Y exceeds X? HINT: The amount by which the rate of return on the second Logo.pptx K investment is higher than the rate of return on the first investment is V - X 2 decimals 9 10 W KE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts